What is salary sacrifice?

Salary sacrifice (sometimes known as salary exchange) is an agreement between employer and employee, where the employee agrees to a reduction in their salary to for other non-cash benefits from their employers including pension contributions, childcare vouchers, bus passes etc.

How does salary sacrifice work?

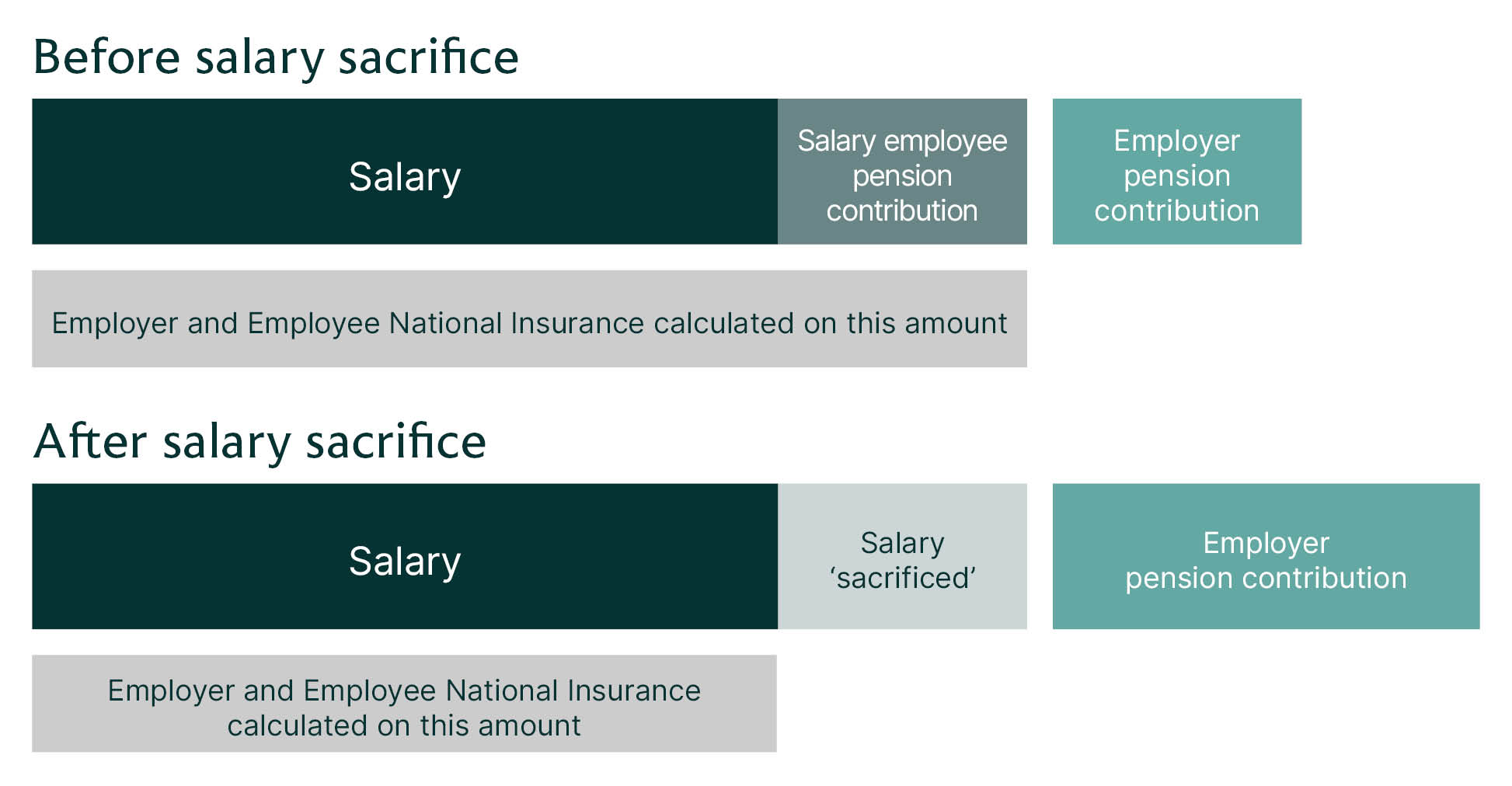

At its most basic, everyone pays less tax and exchanges this for access to other benefits. As employees’ gross wages are smaller, they pay less income tax and National Insurance (NI), and the employer saves on NI too. Employees may be hesitant to reduce their pre-tax salary, but there are benefits for both employee and employer.

With Salary Sacrifice, employees and employers can pay tax savings into the employee’s pension pot – helping them increase their retirement savings. Employers could choose to improve (or create) their employee benefits package thanks to these savings.

As shown in this diagram, both employer and employee pay into their workplace pension pot each month. Reducing the employee’s salary allows the employer contribution to increase. While the minimum an employer must contribute is 3% in the UK, they can choose to contribute more.