-

Why Wren Sterling?

Straight forward and easy to understand – Our advice explains complex areas of financial planning to help you make difficult financial choices.

Expert, valuable advice – Our financial advisors are all qualified Independent Financial Advisers with a team of paraplanning and administrators supporting their recommendations.

Tailored experience – Answer all questions, and confidence you’re in safe hands.

Research to support our recommendations – Our advisers are supported by research and compliance teams to ensure the quality of their advice.

Financial Advisors in London

Find local advice with Wren Sterling's network of financial advisors based in London

Speak to our London financial advice team

Our team of independent financial advisors assists clients in London and the surrounding area. You can find us a few steps from Liverpool Street station. The London office is also hosts most of our Workplace team, offering financial advice for businesses. Or if you’d prefer to not discuss your financial planning in London, we can provide remote advice with your London financial advisor by phone or online.

Contact us to arrange an initial meeting to see if we can help, with no obligation to proceed.

-

0370 143 2100

-

contactus@wrensterling.com

-

New Broad Street House, 35 New Broad Street, London, EC2M 1NH

- Directions

Financial Planning services available in London

From investment advice to pension planning, our advisors in London can help you take control of your finances and plan for a strong financial future.

- Investments in London– make your money work harder

- Retirement planning in London – learn how to use your pensions efficiently

- Protection in London – plan for the unexpected

- Workplace in London – financial planning for businesses and individuals all under one roof

- Mortgages in London – helping you find the right mortgage for you

Meet the London team

-

Phil Jenkins

Chartered Financial PlannerPhil is a Chartered Financial Planner, a Fellow of the Personal Finance Society and an Occupational Pension Transfer Specialist. Phil has been…Read more -

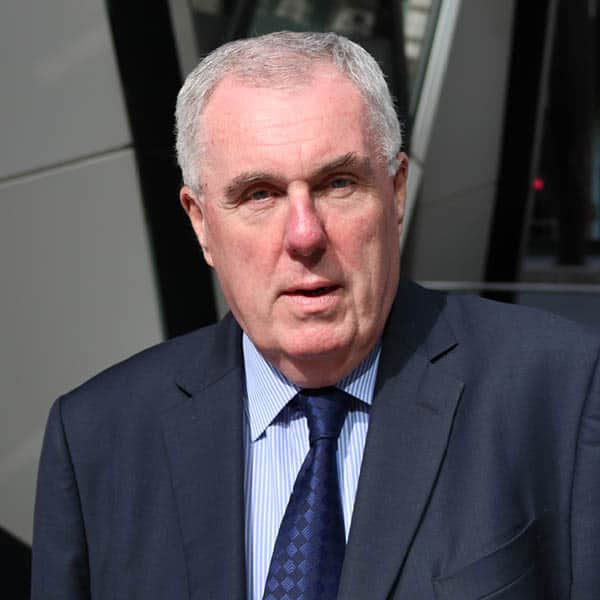

Paul Mitchell

Director, Corporate SolutionsPaul has worked in the employee benefit industry for over 25 years, 15 of which have been spent advising companies on their employee benefit strategy.…Read more -

Ray Jackson

Independent Financial AdviserRay joined Wren Sterling in March 2021. He has been in financial services since leaving school to join NatWest where he worked in many varied roles…Read more -

Tim Seegar

Independent Financial AdviserTim joined Wren Sterling in 2013, and has been advising many of his clients for over 20 years. Tim has formed strong and lasting relationships with…Read more -

Ghazenefar Ahmed

Independent Financial AdviserGhaz has worked in financial services since 2010, and as a qualified independent financial adviser since 2018. Ghaz joined Wren Sterling from HSBC and…Read more -

Sarah Herd

Head of WorkplaceSarah has worked in the financial services industry for over 25 years. She joined Wren Sterling in 2016 having worked as an independent financial…Read more -

Bryan Stott

Corporate ConsultantBryan has worked in the employee benefit industry for over 20 years and before that he ran his own IFA practice. Bryan has been heavily involved in…Read more -

James Twining

Chief Executive OfficerJames is Chief Executive Officer of Wren Sterling, the Wren Sterling Group and Magnus. He joined the business in February 2022, having previously…Read more -

Nick Moules

Marketing DirectorNick has been in charge of Wren Sterling's marketing since 2016. He is a Chartered Institute of Marketing-qualified marketer with experience in…Read more

Your home may be repossessed if you do not keep up repayments on your mortgage.

The value of investments can go down as well as up and you could get back less than you invested.