We’ve spoken at length before in this magazine about the transfer of wealth down the generations but right now there’s another transfer of wealth taking place that is forcing a similar rethink.

For many years, financial planning was designed for men, delivered by men. Gender typical households meant the man was the breadwinner, while the woman raised children and took a fleeting interest in finances.

Not so much anymore. By as early as 2025, up to 60 percent of wealth could be in the hands of women. Through a combination of inheriting wealth from a deceased spouse, the proceeds of divorce and increasingly, their own careers, women are a huge part of the future of the financial planning market.

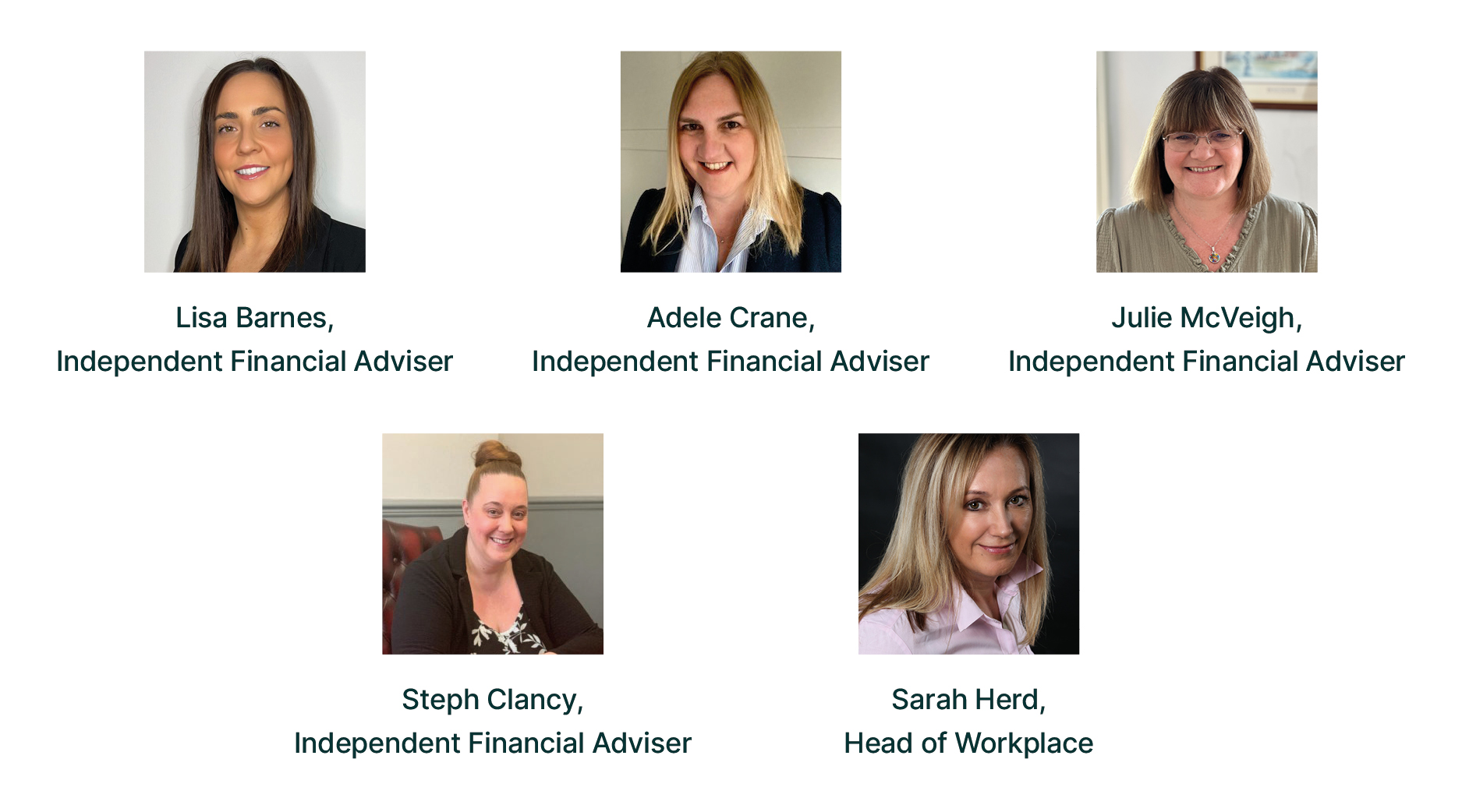

We caught up with five female financial planners to get their perspective on whether there’s a change of behaviour required to advise women effectively and whether the financial planning market is set up to accommodate such a change in dynamics.

Money Matters: First question to all of you, do you think you need a different approach to advising women?

Steph Clancy: I had a meeting a few weeks ago with a widow who specifically requested a female adviser because she was worried about working with a man in this context. She had left finances to the man in the traditional way but now she needed to engage with us to plan her finances. She had a low level of understanding because she had never had to understand and I think that’s the type of client we’re going to see more of, if the research you quoted is accurate.

Julie McVeigh: I’ve had some of the same experiences but I have also had the opposite experience. I used to work with a large factory (I’ve worked with various professions) and very often the typical role was for the spouse to manage the household, and this included all finances. I found the behavioural changes were mainly in white collar versus blue collar. The more ‘professional’ the man’s occupation, the more likely he was to deal with the finances.

Lisa Barnes: I don’t change my approach whether it’s a male or female client, I’m driven by the level of understanding the client has. If you’re talking to a female accountant or director, their level of understanding will be very high.

Sarah Herd: I think it’s generational and when I started out, most clients were men because of the way society operated. I find it’s more about people feeling in their comfort zone and looking to speak to someone more in their own peer group, male or female. As the demographic of those holding wealth has shifted, the industry has changed its approach.

We’ve seen an increase in divorce rates, in the last couple of decades, so following the theme that people like to speak to someone in their peer group, you could see how a specialist female advice style could evolve.

Adele Crane: I think there’s an increasing market for women looking for women advisers. There’s a firm near me that specialises is advising women – that is their niche. As well as providing female advisers only to advise women, there’s a huge safety aspect to it. Some female advisers might not feel comfortable one on one in the home of a male client and we have to mention that.

Steph Clancy: Absolutely. If you’re a single female client on the other hand, you might not want to invite a man you don’t know into your house. It makes sense to me.

Money Matters: Do you find you have to take a more educational approach?

Adele Crane: I do find that I lead with education more so than my male clients. I inherited a client bank from a man who generally did not involve the spouse. I suggested they invited their spouse to the meeting.

I’ve also got a couple of young female clients who’ve just started investing but I’m taking the time to talk them through what we’re doing and why. They felt they might get judged by an older male adviser if they were just starting out and I’m really enjoying watching their understanding and enthusiasm grow.

Sarah Herd: That sounds really positive for those women who might have felt excluded for years.

Adele Crane: Yes, I think the penny has dropped that they might be on their own at some point and it’s important to understand what’s happening and feel in control.

Money Matters: What I’m hearing is that generally, your approach doesn’t change too much by gender, and it’s more about circumstance, generation and level of understanding.

We’ve agreed that clients tend to like speaking to their peers, but if the majority of wealth is heading towards women and only around one in six financial advisers in the UK are women, we’ve got a problem. What do you think is stopping more women joining the profession?

Lisa Barnes: I do think it can be harder for younger women to break into the industry. I’m fairly young myself and generally, the clientele in this market is older. I’ve come up against some resistance from older clients who question my experience. I’ve got the qualifications and I’ve advised some very wealthy clients but that’s a first impression challenge that I have to overcome regularly. I got into financial advice because I was a mortgage adviser first and that’s generally a slightly younger clientele, so it has been more of a transition but I imagine a woman going straight from qualifications to the field might struggle.

Sarah Herd: I think flexible working is going to make it a lot easier for women to enter the advice profession. Before Covid, if you had responsibilities at home and you had to be in the office or on client visits the whole time it might put you off. Now, with Teams and businesses adopting a more flexible approach, I think we’re going to see a new generation of women join the profession, which can only be a good thing.

Julie McVeigh: I started off in an administration role and I was doing all the work for my managing director and then my circumstances meant I had more time to step up and I haven’t looked back.

I think it used to be a bit intimidating for women to attend industry events but now I see a much more even spread, which is an indication of a changing industry, but not one anywhere near approaching parity yet.

Money Matters: Why do we think that is?

Lisa Barnes: I think the home duties for women raising a family has not changed as much as society would have us believe, for older generations. Advising clients isn’t a 9-5 job and it does require us to answer the phone in the evening and at weekends, so I can see how that would put some people off.

Adele Crane: I think this job would be difficult to do part-time. I don’t know if I could just switch off in the days I’m not working!

Steph Clancy: When I tried to sit the exams and balance motherhood, it was very hard, but now I’m through a lot of that, the role works well for me and my clients.

Money Matters: We’re covering some of the barriers to women providing financial advice here, which is valuable, because it should mean the profession breaks those down in order to deal with future demand. What do you think we could be doing to better prepare younger women for the sorts of financial decisions that they’re going to need to make in future?

Lisa Barnes: I do think that younger generations are more clued up though. I speak to younger women a lot and many of them are choosing not to have children so they’ve got the lifestyle and the headspace to consider their finances more than perhaps those who have gone down the traditional home-maker path.

Julie McVeigh: Yes. Also, it matters whether you’re single or in a relationship. We know in society that more women are single or divorced now than many years ago, so that is creating awareness because there’s nobody else to rely on.

Adele Crane: Education is the key. Making use of cashflow planning tools to visually demonstrate what life could look like is really impactful. We know that statistically, women outlive men, so it’s the sensible, if slightly uncomfortable, way to approach clients and give women who are in those traditional man-does-the-finances relationships a headstart.

Steph Clancy: Starting much earlier is the key. Involving wives, sons, daughters is the modern approach.

Lisa Barnes: This goes back further to the education system to me. Young adults in school need to know how mortgages work, the value of things and the dangers of credit cards so they’re not getting themselves into debt. We’re still teaching home economics, which is cooking and sewing, but not much meaningful in how to navigate finances.

Sarah Herd: I could talk all day about financial education and when I go and do sessions at our Workplace clients, younger people absorb it all and some of the older employees are saying they wish they knew this stuff years ago. I’ve gone into schools and talked about finances and it was very uplifting. Nobody wanted a credit card after I spoke to them, which probably wasn’t what my employer wanted – I worked for a bank at the time!

Julie McVeigh: Case in point, Sarah, I’ve got a client coming in later to decode her Civil Service Pension. She hasn’t got this support from work, so I’m helping her understand that.

Money Matters: All, thank-you for your time. You’ve articulated some of the challenges and solutions for advising women in years to come, and I suppose the good news is that you are all advising other women and hopefully inspiring them to join you!

The value of your investments can go down as well as up, so you could get back less than you invested. The Financial Conduct Authority does not regulate cashflow planning.