Former Labour Chancellor Roy Jenkins famously described Inheritance Tax as ‘a voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue’.

The Inland Revenue has since become His Majesty’s Revenue & Customs, Inheritance Tax (IHT), which was introduced in 1984 has remained broadly unchanged. Consequently, your Wren Sterling Financial Planner could help you mitigate the potential liability.

Despite our best endeavours, sometimes an element of IHT is inevitable. If this is the case, then there are two further exemptions that can be exploited to reduce the tax payable whilst doing good. From the outset, gifts to charities were exempt from IHT but, with effect from 6 April 2012, this exemption was extended to provide the potential for a reduced rate of IHT.

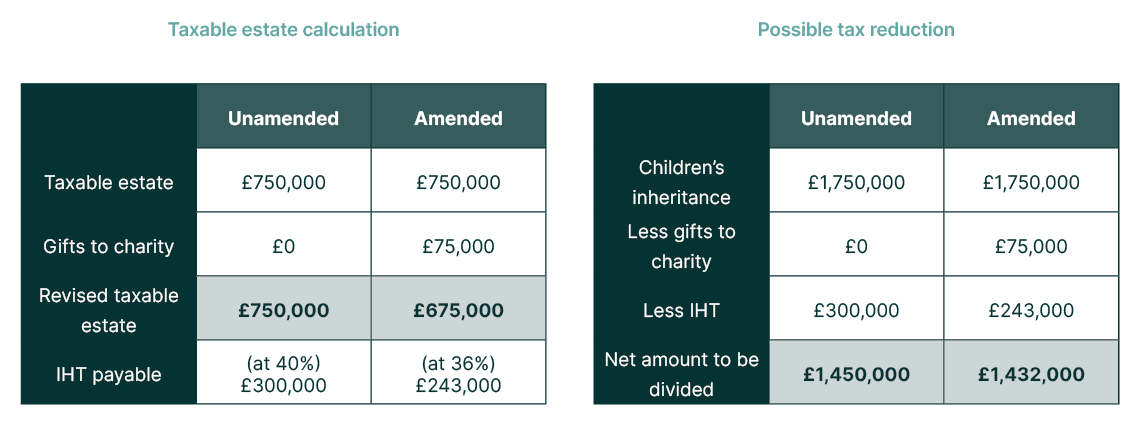

This extension introduced a 10% reduction in the rate of IHT from 40% to 36% if the gifts to charity under the terms of a Will (or Deed of Variation) amount to 10% or more of the taxable estate. This is best demonstrated by way of an example.

An example

The table below is based on the estate of a widow who inherited everything when her husband died and who has now passed away. She leaves behind:

- a property valued at £1,250,000;

- art, antiques and collectibles valued at £250,000;

- and savings of £250,000.

So, an estate of £1,750,000. For IHT purposes, she has her own Nil Rate Band (£325,000) and her Residence Nil Rate Band (£175,000) and she has inherited her late husband’s Nil Rate Bands, making a total of £1,000,000 free of IHT. Consequently, her taxable estate is £750,000. Originally, her Will left everything to her three children equally, but a subsequent amendment introduced qualifying gifts to charities of 10% of her taxable estate (£75,000).

In this example the children’s inheritance is reduced by £18,000 because of the gifts to charity but the worthy causes have benefitted to the tune of £75,000. So, the real loser is the Treasury with a £57,000 reduction in the IHT payable.

What is the definition of a charity?

In the 2023 Budget, the Chancellor changed the definition of a charity. Between 1984 and 2010 the definition of a charity for IHT purposes was restricted to those established in the UK but this was deemed to be in contravention of EU legislation. Consequently, the Finance Act 2010 broadened the definition to include charities established in the EU and EEA (European Economic Area, so Iceland, Lichtenstein, and Norway) provided they met various criteria. The 2023 Budget, with effect from 15 March 2023, has brought us full circle with the reintroduction of a UK-only definition.

What about non-UK charities?

If your Will contains a gift to a non-UK charity it will no longer qualify for exemption from IHT.

For the sake of completeness, there are a couple of other points to make:

- The definition of a charity applies equally to Gift Aid, meaning that Higher Rate Income Tax relief is no longer available on donations to non-UK charities.

- Throughout this article, we have referred to “charities”, but the same provisions have applied to registered Community Amateur Sports Clubs since 2002.