Other than its full name, “great” isn’t an adjective that could be rightly ascribed to Britain for a very long time! We’ve had slow growth; our currency has troughed around its all-time lows and our stock market has dwindled to comprising less than a 4% weight in the global share index.

Although the UK is still a way off from being Cool Brittania in the eyes of investors, we do share Andrew Bailey, the Governor of the Bank of England’s view that the economy has “turned a corner.” We’re not alone here in thinking things are looking up. There’s a marked improvement in UK consumer data and economic data which has sparked some much-needed momentum in the UK stock market. We take the view that the environment is right for this trend to continue and that the ingredients are in place for UK assets to make up the relative losses they’ve endured over the last decade.

Let’s park the assertions to one side and unpack some of the points.

The economy

The UK economy has enjoyed little in the way of economic growth in the period since Brexit. Not nothing, but significantly less than the US (which grown above trend) and a bit less than the Eurozone (which hasn’t exactly been flying!). That looks to be changing. The latest economic growth number showed a flip back to growth from recession and importantly, it was a stronger number than had been expected (with the UK seen to have grown by 0.6% in the first quarter as compared to the 0.4% rate expected by economists surveyed by Bloomberg). Also, we saw a lower-than-expected increase in government spending (which improves the deficit) and an uptick in manufacturing and industrial production, with both measures coming in higher than expected. Green shoots are emerging in the UK economy!

The consumer

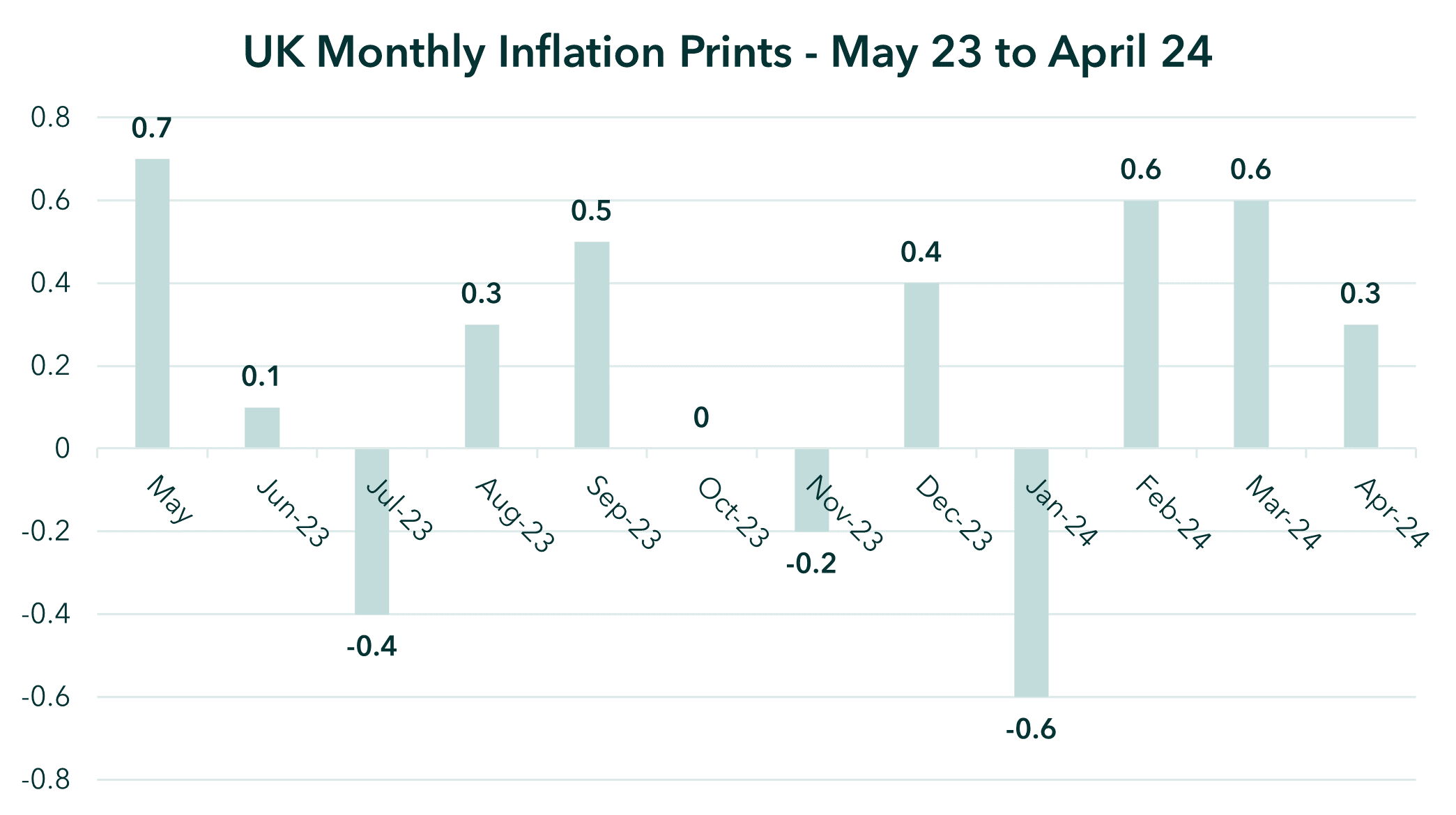

Having weathered the worst of the cost-of-living crisis, the UK consumer is now feeling more confident and has cash in the bank. UK inflation is now down at 2.3% (correct at time of writing, April 2024), having been as high as 11.1% back in November 2022. June sees another lofty month drop out of the 12-month series.

Source: Bloomberg

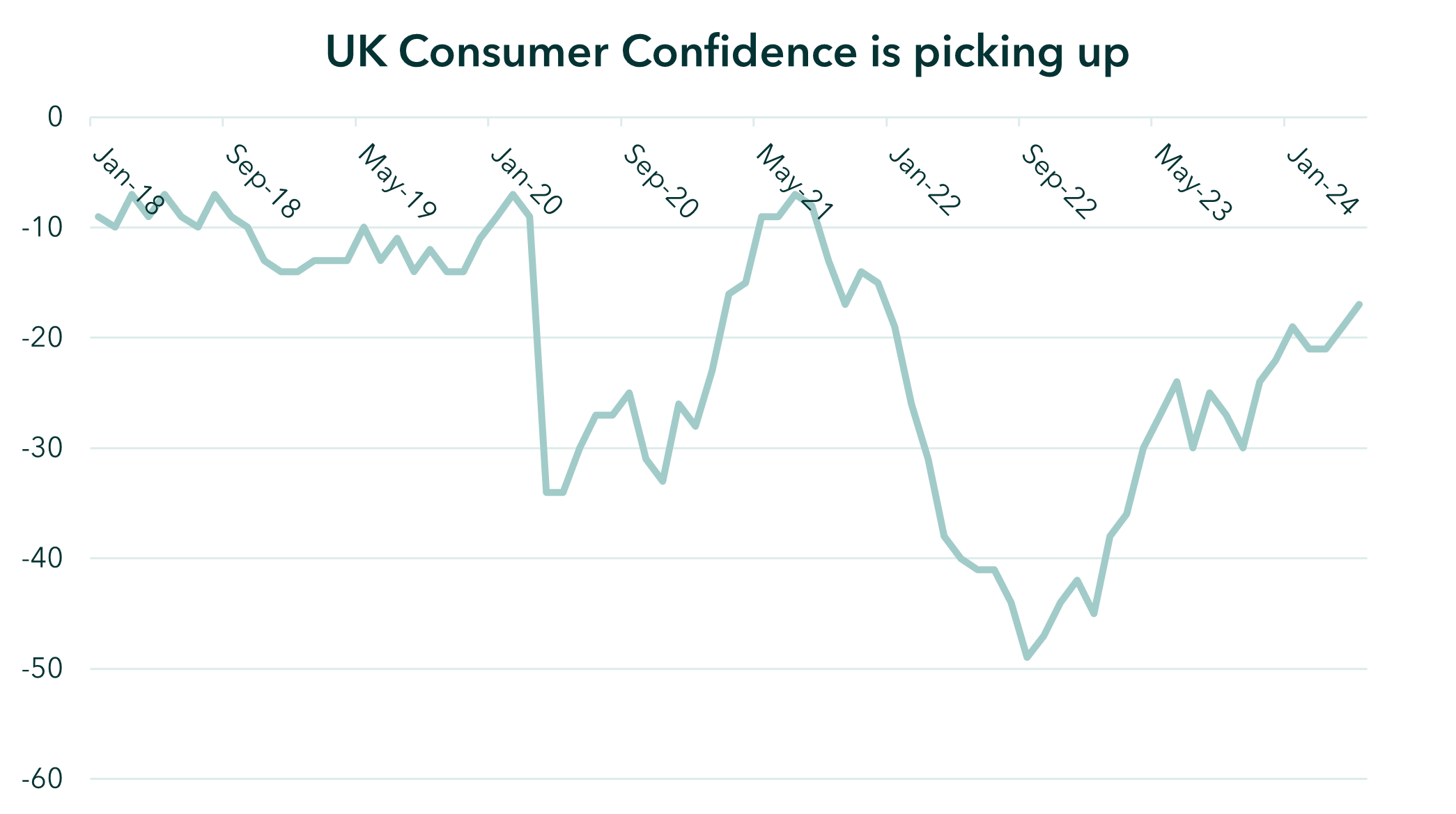

There is every chance that inflation will dip below the Bank’s target as summer hits. Throw into the mix that wages are growing at 6% (i.e., nearly 4% above inflation) and that house prices have risen for 3 straight months and one can see why UK consumer confidence is picking up.

Source: Bloomberg

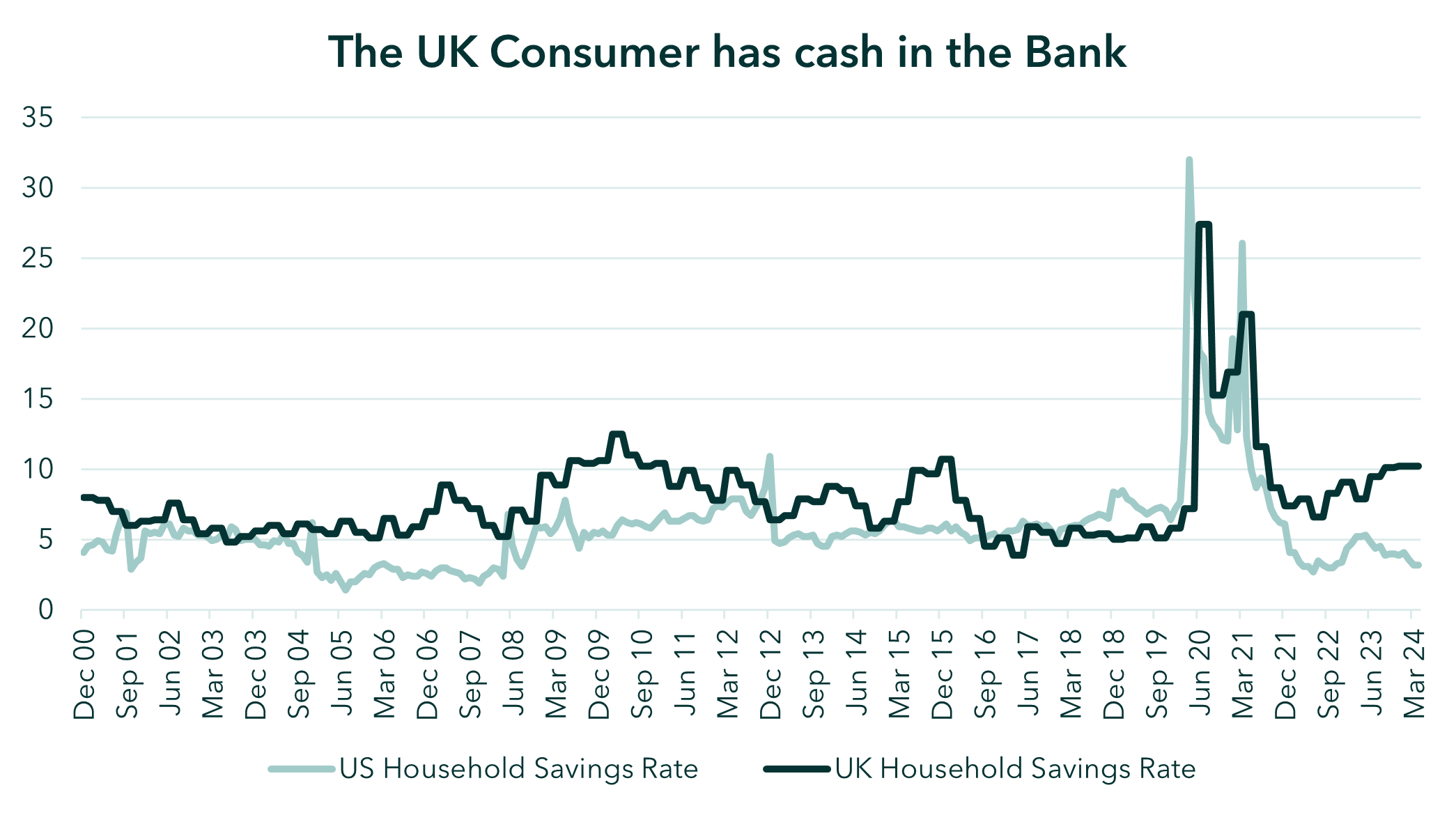

This is the inverse picture to what is happening on the other side of the pond where US consumer confidence (admittedly from a much higher base) is starting to wane as inflation remains more stubborn and real wage growth less pronounced. Having had to be more prudent (and perhaps shunned by the relatively weaker UK stock market performance), the UK consumer has built up strong cash reserves and is able to spend.

Source: Bloomberg

The UK stock market

The UK stock market has been cheap for a long time and cheap for good reason: it hasn’t done very well over the last decade and particularly so since Brexit. Cheap valuations are one thing, but they’re for the birds unless there’s a catalyst. We believe we’re now seeing this, with the powerful combination of share-buybacks and corporate buy-ups. Takeover activity has ratcheted up in the UK this year, with the value of announced bids already close to three times the level seen in the whole of 2023! Admittedly this number is heavily skewed by Anglo American (bid for by BHP Billiton), but that is a further tick in the box for the UK market: Anglo American is a big(ish) company that global investors have heard of and will attract wider attention than that of previous bids. Whilst bids are one element, we’re also seeing companies buy back their own stock at increasing rates, with almost 50% of the UK market having bought back their own stock over the course of the last year. I haven’t even mentioned high free cash flow yields, decent earnings growth, and healthy dividends, but have (hopefully) made the point that the UK stock market has the mechanisms in place to keep moving upwards.

I’ve deliberately avoided politics (until now!). If the pollsters are right and we get a Labour government then that increases the likelihood of some sort of economic pact with Europe which is good for the economy and good for the stock market. The reality is (given the size of the fiscal deficit) that room for manoeuvre (good or bad) will be crimped by the incumbent fiscal deficit.

Politics aside, there’s a lot to be cheery about the UK as we head towards the summer months. Economic data is improving and there’s obvious signs of improved confidence amongst consumers and corporates. It may not be enough to make Britain “Great” again, but the reality for investors is that it just needs to be less bad than it was previously (which isn’t hard, sadly!). Great returns for UK assets are what we’re focused on, and our contention is that the ingredients are in place to support this and we’re reflecting this in our clients’ portfolios.