An extremely busy week just gone for markets with a lot to digest and unpack!

US share markets bore the brunt of the selling, with some of the high-profile technology names hit hardest. Although the underlying corporate fundamentals remain very strong, uncertainty around President Trump’s tariff regime has called into question the strength of the US economy. Tariffs were always going to be President Trump’s “stick” for markets, with the “carrot” of tax-cuts and de-regulation likely coming later in the year.

These, combined with the ability of the US Federal Reserve to cut interest rates (which the market has moved to pricing), should help breathe life into an economy that is still growing but has perhaps shifted down to a lower gear.

This week’s a quiet one for scheduled data points and we’d expect the focus to remain on the US and any announcements from the US administration.

Last week

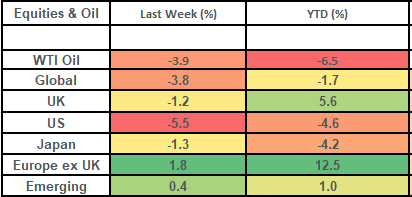

- Global stock markets posted losses as uncertainty around US trade policy (combined with a weak Dollar) caused losses for UK investors

- European markets performed strongly: boosted by hopes of a large German spending package

- The European Central Bank cut interest rates

- US jobs data was released and came in broadly in line with expectations

This week

- The focus will continue to be on the US Administration and any change in policy tone from President Trump

- US inflation data (CPI) is released on Wednesday: which will likely guide bond markets, and their pricing of the next US interest rate cut

- US growth data (for January) is released on Friday

- Several UK companies report their full year earnings including Persimmon and Domino’s Pizza UK (on Tuesday), Legal & General (on Wednesday) and Deliveroo (on Thursday).

Source: Bloomberg

More details:

- Global stock markets had a poor week, falling by 3.8%: their worst week since October 2023. The pull lower was largely from the US market (which fell by 5.5% in GBP terms) and from US technology. The falls in US tech were largely driven by Nvidia, which fell by 12.1% on the week.

- The US market tends to lead the Global market due to it having a high (c71.5%) weighting in the index. Within the US market, Nvidia is one of a handful of stocks known as the “Magnificent 7” which comprise a high weighting (c31% in the index). These companies have earned the “Magnificent” moniker due to their wonderful earnings growth and share price performance over the last 2 years. Last quarter (which got reported over course of the last month), as a cohort, they have posted strong earnings growth (c30% year-on-year) but it has not been at the “Magnificent” levels of prior quarters (at end Q3 their aggregated growth rate was c100% year-on-year). This has led to a re-set in the market as investors pivoted away from these stocks.

- Despite the ructions of the last week, we’d note that US companies as a whole have just posted their strongest quarter of earnings growth since Q4 2021: hence although the market is concerned about tariffs and the impact on trade, the underlying fundamentals remain strong.

- Tariffs and trade uncertainty was front of mind for global investors last week with lots of back and forth from President Trump. Last Tuesday marked the deadline for Trump’s previously announced tariffs of 25% on Canadian and Mexican imports along with an additional 10% on Chinese imports. These measures hit the market hard which (despite President Trump saying “I’m not even looking at the market”) may have been a reason for the Trump administration then announcing a slew of exemptions and delays for the tariffs later in the week!

- Regarding Tariffs and President Trump, we’d note that although they’re clearly not helpful for markets, the magnitude that we’re seeing is less than that which was telegraphed pre-inauguration. Furthermore, there was always going to be an element of “stick and carrot” to President Trump. Tariffs are clearly the “stick”, and they can come quickly (due to the ease of implementation via the swish of a pen on an Executive Order), whilst tax-cuts and de-regulation are the “carrot” which come later due to needing to pass through Congress and / or Legislative processes.

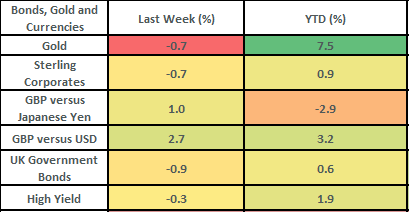

- Pullbacks of the order we’re seeing can be unsettling but we’d note that they are normal and historically have led to buying opportunities for investors and an opportunity to move into markets. Additionally, we’d note that Central Banks are now in a position of strength and can cut interest rates aggressively should weakness develop in the economy. Interest rates are 4.5% in both the US and the UK, and the bond futures markets are now pricing in that we’ll see 3 interest rate cuts from the US Fed this year and 2 more from the Bank of England. This would support consumers and would also likely tease some of the large cash piles in US money market funds away from cash and back into markets. There’s just shy of $7trillion in US money market funds (based on data from the St Louis Fed), with over $2 trillion of this being from US retail investors.

- Outside of the US, equity markets were much more contained. UK stock markets fell back by 1.2%, whilst European and Emerging market stock indices posted weekly gains of 1.8% and 0.4% respectively.

- European stock markets got a big boost from the German stock market (c19% of the Continental European Index), on the back of a large plan to boost spending. We’d note that this still has to get through Parliament, but last week saw Friedrich Merz’s Conservative Alliance and the Social Democratic Party (both of whom are in talks to form the next government) table a spending package potentially totaling 900 billion Euros! This would include a 500-billion-euro infrastructure fund and then create further spending power by loosening debt rules for individual states and boosting defense spending.

- European assets got a further boost from the European Central Bank, cutting interest rates on Thursday, taking rates down to 2.5%.

- Finally, Friday saw the release of the monthly US jobs data. Usually this is a huge focal point for markets, but the reality was that the market was consumed with what was happening with Tariffs and President Trump! That aside, the data came in broadly in line with expectations with 151,000 jobs seen to have been created in February (vs expectations of 160,000). The unemployment rate ticked up by 0.1% to 4.1% (still low by historical standards, with the long-run average level being around 5.7%). It’s worth noting that these numbers do not reflect the federal government layoffs which will likely dampen the March numbers (as that is when they’ll likely feed through to the data).

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.