Last week opened with equities sharply lower, extending losses from the previous week, as negative sentiment intensified ahead of Wednesday’s implementation of the Trump administration’s latest round of tariffs.

While Trump has managed to shrug off stock market declines, the bond market is a different animal. Throughout modern history, bond investors have served as the ultimate guardrail—reigning in Presidents and Prime Ministers when policy veers disastrously off course.

“The Bond Vigilantes have struck again. As far as we can tell, at least with respect to US financial markets, they are the only 1.000 hitters in history.” Ed Yardini[1]

And therein lies the message for politicians: Ignore the friendly economists with their pretty charts and equations, and eventually the less friendly bond traders will show up—with baseball bats.

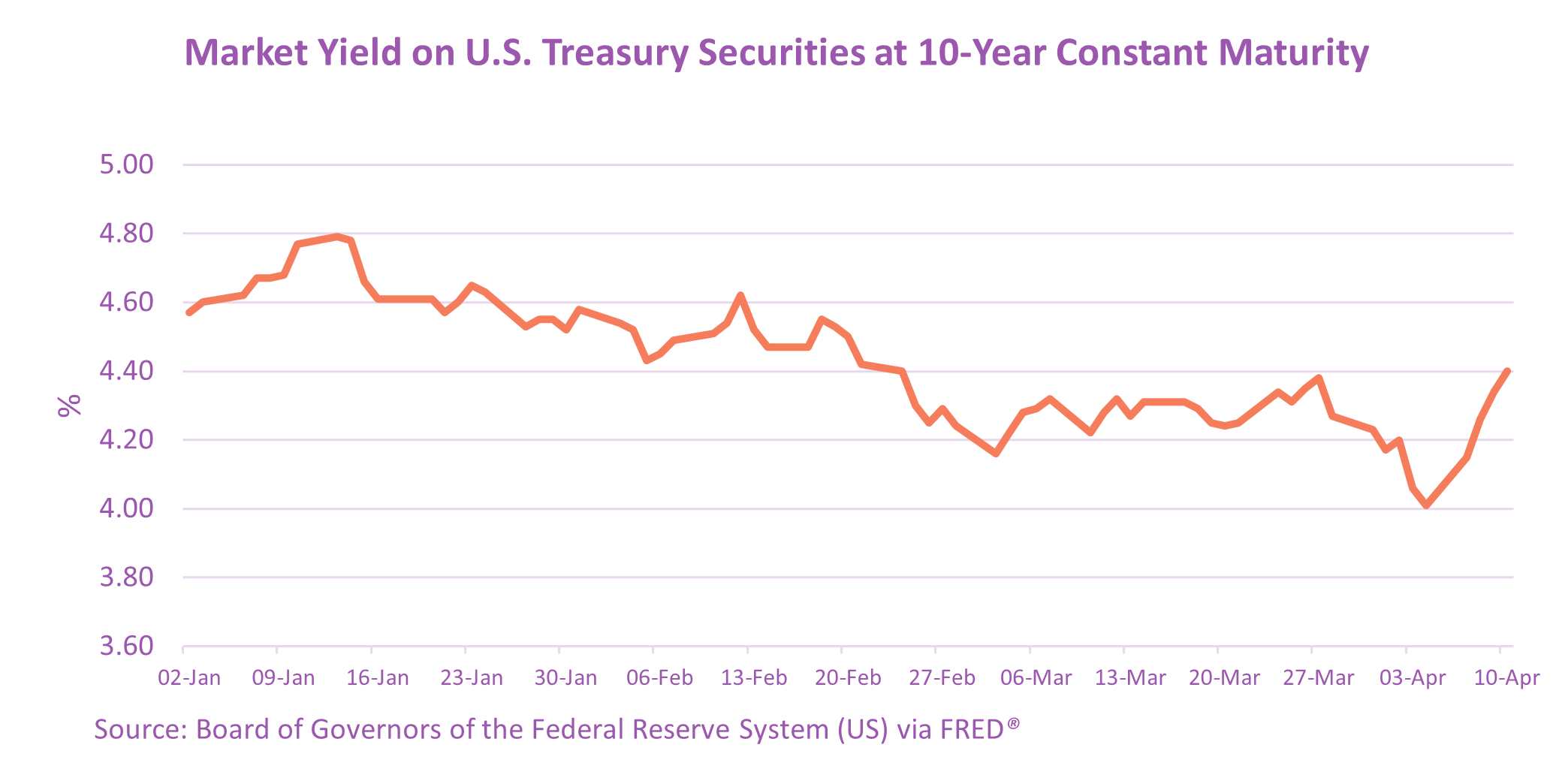

The 10-year Treasury experienced its biggest three-day jump since 2001, with yields soaring from below 4.0% on Friday to 4.5% by Wednesday.

[1] https://www.yardeniquicktakes.com

While the 10-year yield remains below the 4.8% peak seen in January, it was the speed of the sell-off that sent pulses racing. The damage was even worse further out on the yield curve. The real 30-year yield—a window into the long-term cost of money—spiked to levels last seen during the 2008 Global financial crisis.

This is opposite of what typically happens when recession risks rise and the stock market sinks. Normally, you’d expect a flight to safety. US Treasuries are the bedrock of the global financial system. Investors are struggling to price in a toxic mix of political dysfunction and inflation uncertainty.

Whatever sparked the bond market sell-off, margin calls from hedge funds, large US debt holders selling down, it was enough to make Donald Trump blink. On Wednesday, Trump paused the “reciprocal” tariffs for 90 days—on all countries except China. The baseline 10% universal tariff would remain, and China would face an increased 125% 145% rate. China responded with an 84% rise in tariffs on US imports to 125%, interestingly just below the US rate, allowing Trump latitude to change his mind in the future too without losing face.

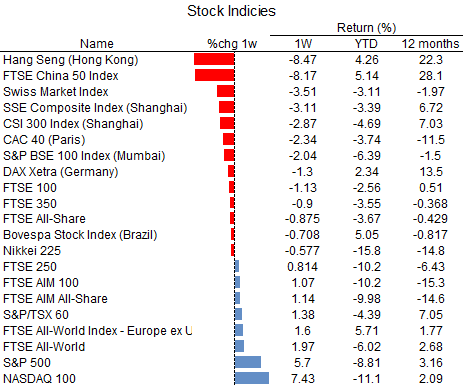

The news sent stocks rocketing higher, with the Nasdaq Composite gaining over 12% and logging its second-best day on record. The escalating trade war between the world’s two largest economies, along with the broader impact it could have on global economic growth dampened some of Wednesday’s positive sentiment, which led to stocks giving back some gains on Thursday. Once the dust had settled the S&P 500 Index finished up 5.70% for the week, while the Nasdaq Composite closed 7.4% higher. The FTSE All world lagged but still posted 2% gains.

Meanwhile in China stock markets recorded a weekly loss, but declines were tempered by hopes that the trade war with the U.S. would lead Beijing to roll out fresh stimulus that would boost the economy. The onshore benchmark CSI 300 Index shed 2.87%, and the Shanghai Composite Index fell 3.11% in local currency terms from the prior week’s close. In Hong Kong, the benchmark Hang Seng Index slumped 8.47%.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.