Notwithstanding a strong rally on Friday, Global stock markets had another tough week, with the Global stock market falling into “correction” territory. Despite having endured a 10% pull-back from their highs, it is worth remembering that Global stocks are still up by over 30% over the course of the last 2 years and that such corrections are not uncommon.

There’s a lot going on this week (with 3 big Central Bank meetings), but we’d expect the focus to remain on the US administration and its trade policy along with tomorrow’s vote in the German Parliament which could potentially unlock 500-billion-euros of infrastructure spending.

Last week

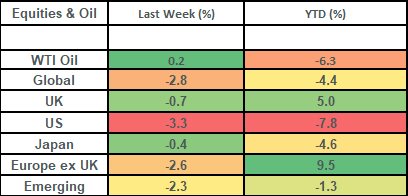

- Global stock markets lost ground last week as the US market continued to weigh on returns

- Trump tariff uncertainty also hit European markets: although they remain in decent positive territory for the year-to-date

- Germany’s Christian Democrat party got support for a large fiscal package to take to a vote in Parliament this week (likely tomorrow)

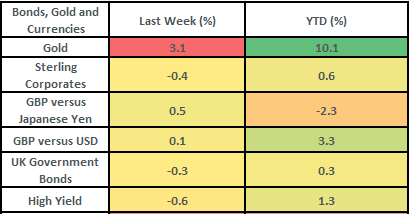

- Bond markets pared their gains for this year as yields and spreads both rose.

This week

- Once again, despite a packed schedule, markets’ attention will likely be on President Trump and the US administration’s trade policy

- Aside from that, we’ve got interest rate decisions from the Bank of Japan (Wednesday), the US Federal Reserve (Wednesday) and the Bank of England (Thursday). We are not expecting any change to policy rates at these meetings (neither is the market) but market participants will be keen to see the updated “Summary of Economic Projections” from the US Federal Reserve. This gives a future indication of where they see the path of interest rates going (the most recent December version suggests 2 interest rate cuts for this year).

- UK employment data is released on Thursday

Source: Bloomberg

More details:

- Global stock markets fell by 2.8% last week, with the US stock market down by 3.3%. Despite a decent bounce on Friday (where it rose c2%), the US stock market fell into what is termed “correction” territory over the week: falling by 10% from its recent peak. Whilst such corrections are uncomfortable, they are not uncommon for stock markets: over the last 21 years of global equity market returns, we’ve had 12 years with intra-year sell-offs of 10% or more.

- For long-term investors, we believe that corrections in the market can be used as opportunities. Good market returns often come just after drawdowns and missing out on those returns can mean missing out on big gains. Looking at the last 21 years of global equity returns suggests that trying to time the market can be a dangerous game. In fact, just missing out on 30 of the best days in that 21-year period (i.e. about 0.6% of the time) would have “cost” an investor just over 25% of their total return.

- US and Global market performance underscores the importance of diversification (and is one of the reasons we include an overweight position to UK equities in our Clients’ portfolios). The US market has been weighed down by losses in the Magnificent 7 (which entered a bear market last week: these stocks fell by just over 20% from the period 17/12/24 to 13/3/25) which represent c30% of the US stock market (a market of 503 stocks!). However, other equity markets have been strong this year: notably Europe and the UK.

- Added to the pull-back in valuation amongst the big US technology stocks there has been a rise in uncertainty caused by the US administration’s policy towards trade. Last week saw the Trump tariff talk ramp up with 25% tariffs on steel and aluminum coming into effect on 12th March. This prompted retaliation by Canada and the EU (imposing reciprocal tariffs on US goods worth $20 billion). In turn, this led to increased threats from President Trump of a 200% alcohol tariff on EU countries unless the 50% tariff on US whisky is stopped. Doubtless a deal will be reached, but markets hate uncertainty and currently this is a fog diverting attention from good corporate fundamentals: notably companies which are growing their profits!

- Germany’s coalition government in-waiting and the Greens agreed to a deal for a huge increase in state borrowing and a loosening up of debt restrictions. This package includes a 500-billion-euro infrastructure fund. Despite pulling back last week, this is one of the reasons that European markets (notably the German DAX which is up 17% YTD in GBP terms) have been so strong this year. This package has not been approved by the Government yet, but it is expected to pass in the Bundestag on Tuesday this week. This would be before the newly elected parliament is set to convene (on March 25th). The urgency is heightened since the incoming parliament (on March 25th) would likely not support the deal due to the AfD party and the Left party’s opposition to military spending.

- Bond yields ticked a bit higher last week, which meant for modest losses in UK sovereign markets. However, Gilts do remain in positive territory for the year as do Sterling Corporate bonds. High Yield bonds gave up a bit of ground last week as spreads (the extra return these borrowers must pay over and above government bonds) rose on the increased uncertainty in markets. US high yield spreads are now around 3.2%. This is a fair bit higher than where they started the year (about 2.9%) but is still some way below where they were in the market sell-off in August last year (where they reached 3.8%) and they are still comfortably below their 5-year average (3.9%) and their long-run average (4.9%). This suggests to us that corporate health remains strong and that the heightened uncertainty we’re seeing is more of a bump in the road rather than anything more sinister.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.