Global stock markets sold off last week, with the US share market dragging the global index lower. Outside of the US, returns were fairly good, with UK shares leading the way. This week the focus will remain on the US, and all news out of the Trump Administration, but there’s also lots of companies reporting their earnings’ numbers. To that end, this week sees the likes of Tesla, Boeing, Intel, and Alphabet report numbers alongside some of the big UK companies.

Last week

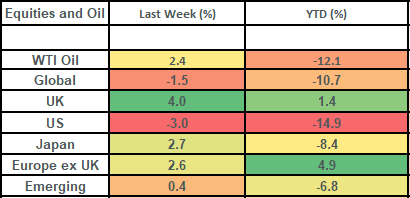

- Global stock markets fell, with US share markets weighing on returns.

- UK shares posted a strong week.

- UK inflation came in lower than expected: opening the door for an interest rate cut in May.

- The European Central Bank cut interest rates

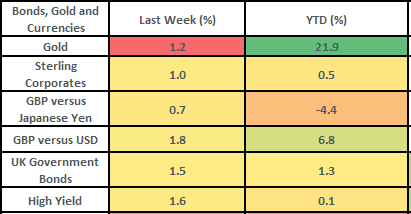

- Bond markets had a strong week.

This week

- All eyes will be on the Trump Administration and any developments around trade policy.

- Additionally, there are some key US companies reporting results this week (Tesla, Boeing, Intel, Alphabet and Schlumberger)

- Flash PMI data is released on Wednesday

- UK retail sales data is released on Friday

Source: Bloomberg

More details:

- Global stock markets fell by 1.5% last week, with all of this fall coming from the US market and the weakness in the US Dollar vs the Pound. The US share market was down by 3% on the week in GBP terms and this created a meaningful drag on the index: given that the US share market has a weighting of c70% in the global share index! Returns (for Sterling based investors) were not helped by Dollar weakness / Pound strength, with the Pound up by 1.8% on the week vs the US Dollar which further crimped Dollar based returns.

- Technology shares weighed on the US market, with Nvidia down close to 10% on the week. This followed news that the US administration would be putting new export restrictions on semi-conductors to China. There was further selling yesterday in US stocks, with President Trump putting more pressure on Fed Chair Powell to cut interest rates. This followed a post by President Trump last week on Truth Social where he said his “terminated cannot come fast enough.”

- The UK share market continued to be a relatively bright spot, with the UK equities rising by 4% on the week! Showing its diversifying characteristics: it has very little exposure to technology (unlike the US) and is heavily weighted to Consumer Staples, Financials, Industrials and Energy. Last week saw the financials sector continue its bounce back from the “liberation day” sell-off, with the Banking sub-index up by over 6% on the week: taking returns for the year-to-date to just over 9%.

- UK shares also got a boost from inflation coming in lower than expected and wages slowing more than expected. This means that there is less pressure on the Bank of England to keep interest rates high and, in fact, a stronger argument for cutting them! We expect the Bank of England to cut rates by 0.25% when they meet in May and then a further 2 times this year: to end the year with interest rates at 4%.

- UK CPI came in at 2.6% last week. This was less than the prior reading of 2.8% and less than had been expected. Pleasingly, services costs and wages, both showed signs of coming down: this is important as these 2 have been drivers of keeping inflation above target. This will be the last inflation print before the Bank of England meets on 8th Inflation is likely to rise in the 2nd half of the year (not least due to the rising energy, water, and council tax bills) but we still expect the BoE to press in with wage cuts in the face of weaker wages and weak growth.

- Bond markets bounced back last week, with returns driven by a combination of falling government yields and tightening credit spreads. This saw UK gilts rise by 1.5% on the week (with the UK 10 year gilt closing the week yielding 4.56%) and credit markets rise by about 1% (Investment Grade) to 1.6% (High Yield). US high yield spreads ended the week back below 4%, having moved out to 4.53% in the worst of the selling post “liberation day”.

- The European Central Bank cut interest rates last week by 0.25% to 2.25%. This marked the 7th consecutive interest rate cut by the European Central Bank. Bond futures markets are expecting 2 to 3 further cuts by the ECB this year. The ECB noted that growth had “deteriorated owing to rising trade tensions.”

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.