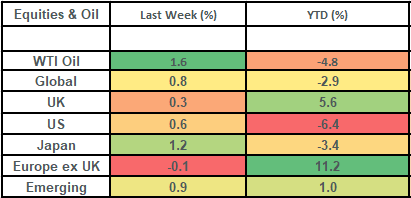

Global stock markets posted modest gains last week, with US shares posting a rebound. Continental European share markets took a breather last week, having rallied hard in anticipation of the German Parliament passing a large spending bill (which it did). This week sees the spotlight on the UK, with Wednesday seeing inflation data released but also Chancellor Reeves’ Spring Statement.

Last week

- Global stock markets posted modest gains, with the US market driving returns.

- The US Federal Reserve kept interest rates on hold at 4.5%, with President Trump weighing in, urging them to be “cutting rates.”

- The Bank of England kept interest rates at 4.5%.

- UK stock markets posted modest gains: helped by Oil majors and Banks.

- European markets paused for breath after a strong recent rally on the expectation that the German Parliament would pass a large spending bill (which they duly did)

This week

- Wednesday is a big day for the UK, with inflation data released in the morning (we expect CPI to come in at 2.9%) and the Government’s “Spring Statement” at lunchtime.

- UK retail sales are out on Friday.

- US PCE inflation (the US Fed’s preferred measure of inflation) is due out on Friday

- We also have a smattering of UK companies publishing earnings’ reports, with Travis Perkins out tomorrow and Next on Thursday.

Source: Bloomberg

More details:

- Global stock markets rose by 0.8% last week, with the US market (c70% of the global index) driving gains. Within the US market, there was a recovery from the recent sell-off, some better economic data and a soothing tone from the US Federal Reserve (in their press conference).

- In terms of US economic data, last week saw a pick-up in housing data (more homes being built and more homes being sold) and a big pick-up in both Industrial production and Manufacturing output data. Doubtless some of the boost to these numbers came from businesses buying inputs ahead of expected tariffs but it is also consistent with broader data which shows that a recovery in US manufacturing is underway.

- The US Federal Reserve maintained interest rates at 4.5%: this was as expected. They also made no change to their forward guidance (via their “Summary of Economic Projections” or “Dot Plot” as it’s more commonly known), where they still guided towards 2 further interest rate cuts this year. In and of itself, this does not provide much in the way of accommodation for markets. However, Fed Chair Powell’s press conference set the tone for a market rally as he noted that it might be “appropriate to look through inflation” and that a rise in inflation (which the Fed are forecasting) might be “transitory.”

- The bond futures market moved to price a greater pace of interest rate cuts (3 in total for this year) off the back of this. There was also notable pressure from President Trump to cut interest rates, with Trump taking to Truth Social on Wednesday night (the day of the Fed meeting), saying “The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy,” ..“Do the right thing. April 2nd is Liberation Day in America!!!”

- The UK stock market made modest gains last week with the oil majors Shell and BP (which carry a combined weight of 11% in the FTSE 100 index) up by 3.6% and 4.9% respectively; benefiting from a high oil price. There were also further gains amongst UK banks, with the FTSE All Share banking sector up by 1.2% on the week; taking its gains to the year to 17% (following a 42.7% rise last year!).

- European stock markets paused for breath last week yet remain up by 11.2% for the year-to-date. Last week saw the German parliament pass a reform of the Country’s borrowing rules (the loosening of the so-called “debt brake”) as well as the signing off a 500-billion-euro fund to revamp its infrastructure. This is a massive move and a huge change in direction for Germany (and the Eurozone), but it had been very much baked into asset prices in the weeks running upto the vote. Germany is the 3rd largest economy in the world (hence it matters!) and has historically run relatively low debt levels (c60% of GDP as compared to c98.5% in the UK and 123% in the US [1]). The German economy has not grown in any meaningful fashion for the last 5 years hence the excitement that this new reform might create!

- The Bank of England held interest rates at 4.5% last week (in an 8-1 vote, with 1 member voting for a cut). The Monetary Policy Committee noted the increased “geopolitical uncertainties,” with a distinct nod to “tariffs”. Bond futures markets (as per data from Bloomberg) are expecting two further interest rate cuts from the Bank of England this year: this would see UK interest rates finish the year at 4%.

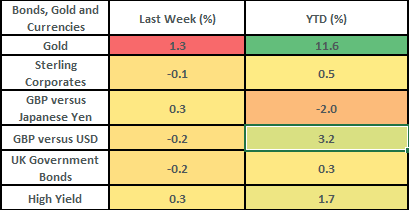

- Bond markets were modestly down on the week, with UK gilts falling by 0.2% and UK corporate bonds falling by 0.1%. UK 10-year government bonds closed out last week yielding 4.7%.

[1] Source: Bloomberg, CEIC data and the Office of National Statistics

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.