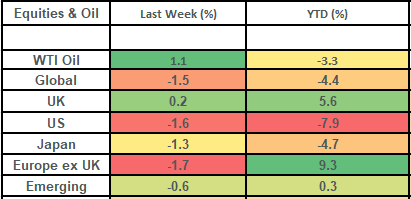

Global stock markets sold off last week (falling by about 1.5%), with much of the fall coming at the end of the week in response to US tariff announcements. Away from the noise on global trade policy, the UK stock market continued to grind out positive returns, with retailers such as Next positing good numbers. We’d expect uncertainty to remain the driving force in markets this week in anticipation of President Trump’s so-named “Liberation Day” on Wednesday.

Last week

- Global stock markets fell on heightened uncertainty around US tariffs.

- US technology stocks bore the brunt of the selling (but their earnings outlook still looks positive)

- UK shares had a decent week, with retailers such as Next making the case for the stock market not being equal to the economy!

- UK inflation fell back to 2.8%: which gives the Bank of England a window to cut rates (and ease borrowing costs!) in May.

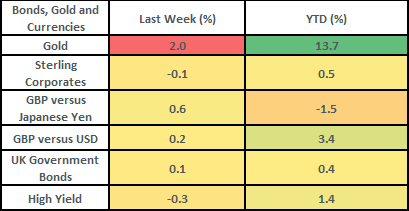

- Government bond markets rose modestly on the week.

This week

- Wednesday is the focal point for markets this week as it is when President Trump is set to announce his reciprocal tariffs (which will officially go into effect on Thursday).

- US monthly jobs data (out on Friday) is generally a closely watched number. Economists (as surveyed by Bloomberg) expect US unemployment to hold steady at 4.1% but the market will be looking for any evidence of Government job cuts feeding through.

- Eurozone inflation is due out tomorrow.

- The earnings calendar is light, with Travis Perkins (Tuesday) and Raspberry Pi (Wednesday) reporting in the UK.

Source: Bloomberg

More details:

- Global stock markets fell by 1.5% last week as US tariffs and trade policy continued to dominate sentiment. The US administration announced a 25% tariff (effective April 2nd) on all autos not made in the US. This hit European markets (where countries such as Germany have a relatively large weighting to the Automobile sector within their benchmarks) as well as US shares. Within the US market, it was the technology sector which was the worst performer.

- Large US technology and consumer stocks continue to bear the brunt of the selling. US technology (as a sector) is now down by 15.5% for the year-to-date, with the “Magnificent 7” stocks down by 18.4% year-to-date. It is worth remembering that these 2 groups of stocks were up by 38% and 71% respectively last year, having risen by 48% and 96% respectively in 2023!

- The increased uncertainty created by the prospect of tariffs and protectionist trade policy has hit the US market particularly hard and US shares have been the worst performers amongst global markets so far this year. This has brought valuations of US stocks back down to more attractive levels, with the S&P 500 now trading on a 12-month forward price/earnings valuation of 20.5 times.

- A big part of the concern amongst market participants has been the level of profits that US companies will make and the willingness of the US consumer to keep spending. Whilst expected profits have been revised downwards for US corporates, they are still expected to grow their earnings by 7.3% in the first quarter of 2025 and technology companies (which have faced much of the selling) have actually been amongst the most resilient with respect to their earnings projections (with first quarter earnings growth expected to come in at just shy of 15% year-over-year). If this feeds through (results are due in April), it will make for the 7th consecutive quarter of positive earnings growth from US corporates. Rising corporate profits are the biggest driver of share price returns over the long term and this will likely be where the market focuses once uncertainty around trade policy subsides.

- UK shares had another decent week, rising by about 0.25%. Within the UK index, there were some strong share price gains from the retailers, with Next up by 12% on the week and Marks & Spencer up by 6.2%.

- Next Plc raised its sales and profit guidance last week (despite the Office of Budget Responsibility downgrading the UK economy’s 2025 growth expectations!). Next expects to make £1.1 billion of pretax profit in the year to January 2026, with much of this being driven by a rise in sales. News like this, combined with Lloyds bank’s rise of 4% last week (taking share price gains for the year-to-date to 34% in the context of the UK banking sector which is up 18% for the year-to-date) is a good reminder that the stock market does not equal the economy and that companies can be innovative and grow profits even with a tough backdrop!

- US Core PCE (Personal Consumption Expenditure) came in at 2.8% last week. This was a touch higher than expected (expectations were for a reading of 2.7%). This matters since it is the US Federal Reserve’s preferred measure of inflation. That said, bond markets are still pricing in 3 interest rate cuts from the US Fed this year: with the next one coming in June.

- Chancellor Reeves’ Spring Statement passed without major incident. She made a point of noting that inflation continued to come down, with last week seeing UK CPI come in at 2.8%. This will make it easier for the Bank of England to cut interest rates. Bond futures markets are pricing the next cut in at the 8th May meeting, with another cut being priced for later in the year.

- Bond markets rose modestly last week, with UK gilts up by 0.1%. This saw 10-year UK government bonds close out the week with a yield of 4.69%. Credit markets sold off modestly, with UK investment grade bonds falling by 0.1% on the week and high yield bonds falling by 0.3%. Despite the heightened levels of uncertainty, it is worth noting that credit spreads (i.e. the extra amount over and above governments that companies must pay to borrow money) remain tight by historical levels and have been relatively well contained over the last 6 weeks.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.