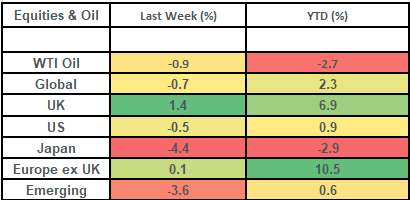

Global stock markets posted modest losses last week as the US market (and notably the US technology sector) weighed on returns. This came on the back of Nvidia’s earnings’ results. Although these were strong, and better than expected, they beat by a smaller margin than they’d done in the prior 8 quarters, with the stock selling off on last week’s results. Whilst this weighed on the global index (given its high concentration), the UK share market gave us lots of reasons to be cheerful: posting another strong week to take returns for the year to just shy of 7%. This week sees a fair few UK companies reporting as well as the monthly US jobs data (out on Friday) which is always closely watched by markets.

Last week

- Global stock markets posted modest losses: weighed down by US technology stocks and impending tariffs from President Trump.

- UK stocks continued their strong run.

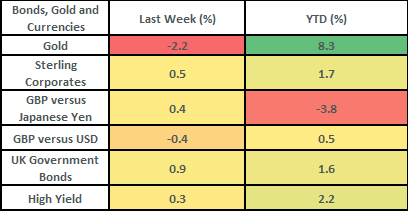

- Bond markets performed well.

- UK economic data was strong.

- US earnings season continued to post some very strong rates of growth but the “Magnificent 7” haven’t beaten estimates to the same degree as they’ve done previously.

This week

- We must wait till Friday for the big economic data point this week, with the release of the monthly US jobs data (non-farm payrolls) and unemployment data.

- The European Central Bank meets on Thursday: we expect them to cut interest rates to 2.5%.

- There’s a fair few UK companies reporting their earnings this week including Abrdn, Fresnillo and Greggs (tomorrow), Foxtons (Wednesday), Reckitt Benckiser and ITV (Thursday) and Just Group (Friday).

Source: Bloomberg

More details:

- Global stock markets fell by about 0.7% last week, with the US (given that it has a circa 72% weighting in the global index) dragging the market lower. US technology stocks (which carry a 30% weighting in the US market) dragged last week, with Nvidia (a 6% weight in the US share market) falling by 6.7% on the week which weighed on returns. This came on the back of Nvidia’s reported results, which were actually very good but didn’t quite match the level of outperformance that the company has delivered over the last 2 years (over which time the share price has gone up 6-fold!).

- The UK share market continued its strong performance this year, rising by 1.4% on the week, taking returns for the year-to-date to 6.9%. Rolls Royce (a 2.85% weighting in the FTSE 100) was the star performer last week, rising by 21.7% on the back of superb full-year results. There was also continued strong performance from UK banks, with the banking sector rising by 5.7% on the week. This follows some excellent corporate results for UK banks where they reported earnings growth of just over 30% and combined this with increased dividends and share buybacks. These strong corporate results go a long way to explaining the 21% year-to-date rise for the UK banking sector. We’d note that the c30% earnings growth for UK banks is similar to the aggregate earnings growth for the US Magnificent 7 companies (which have powered US markets over the past 2 years)!

- Last week also saw the threat of tariffs from President Trump weighing on markets. This news came late in the week, with President Trump announcing an additional 10% levy on Chinese imports (effective March 4th), along with 25% tariffs on Canada and Mexico. This news weighed on Emerging market and Japanese stocks.

- Bond markets put in a good showing last week, with UK government bonds rising by about 0.9% on the week and UK corporate bonds rising by about 0.5%. These positive returns came as bond yields fell (bond yields move in the opposite direction to bond prices), with a greater degree of future interest rate cuts being priced in. As at Friday’s close, the bond futures markets are pricing in 2 further interest rate cuts this year for the UK and 3 further interest rate cuts for the US.

- UK economic data was sparse last week but it was generally good. House price data (from Nationwide) showed prices rising faster than expected in the month of February and business survey data (from Lloyds) also showed a pick-up. US economic data was mixed: the 2nd revision to the 4th quarter economic growth number showed growth coming in at a good clip (2.3%), with the consumer element of that growth (personal consumption) being very strong indeed (growing at 4.2%). On the other side of the ledger, US data showed a drop in consumer confidence as uncertainty around the near-term-outlook (likely driven by uncertainty around tariffs) dragged the reading lower.

- US 4th quarter earnings’ reports are now mostly in, with 97% of US companies having reported (according to data from Factset). The growth rate has been very strong, with the blended year-over-year growth rate running at 18.2%. This is much higher than the 11.7% growth rate that was expected back in December last year, is the highest rate of growth since Q4 2021 and marks the 6th consecutive quarter of positive earnings growth! This is a very encouraging number since corporate earnings are the key driver of long-run stock market returns.

- There has been much scrutiny of the earnings of the big US technology and consumer companies; collectively known as the Magnificent 7. They have earned the “magnificent” moniker on account of their outstanding share price performance over the last 2 years.

- The Magnificent 7 account for just over 30% of the weighting in the US share market and accounted for roughly 49% of the total returns last year in the US share market. The earnings reports from these companies for this season have been very good indeed, but perhaps not quite “magnificent”. They have grown their earnings by 30% (in aggregate on a year-over-year basis). This is a great number, but it is less than the 100% growth rate they were running at previously. Our view is that these are indeed magnificent businesses but that they now comprise too big a weight within indexes and can represent a very concentrated holding. As such, we prefer a more diversified approach within our clients’ portfolios.

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.