Stock markets had a very rough week, with global stocks enduring their worst week since March 2020. This came on the back of President Trump’s “Liberation Day” which saw reciprocal tariffs on about 90 countries. These sorts of weeks are unsettling, but we’d urge investors to not make knee-jerk reactions and, instead, stick to their long-term investment strategies. Sell-offs in equity markets are uncomfortable but not uncommon and trying to time the market can mean missing out on some of the biggest gains: which often come during periods of heightened uncertainty.

Last week

- Global stock markets fell sharply as President Trump’s reciprocal tariffs came in higher than expected.

- Selling across equity markets was broad-based, but defensive sectors held up.

- Bond markets provided good ballast.

- Bond futures markets quickly moved to price in a faster pace of interest rate cuts this year (to help support economic growth).

This week

- Developments around tariffs and trade negotiations will likely overshadow all the scheduled data.

- US earnings season gets under way, with several of the big banks reporting on Friday (US companies are expected to grow their earnings at 7% YoY in Q1. The market will be watching what the companies have to say regarding future guidance).

- US inflation is released on Thursday and the most recent Federal Reserve minutes are released on Wednesday.

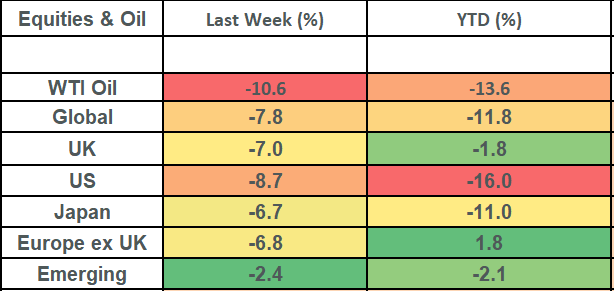

Source: Bloomberg

More details:

- Global stock markets fell by 7.8% last week: their worst week since March 2020 in the covid related sell-off. This sell-off came on the back of tariffs announced by President Trump on April 2nd. Despite being clearly telegraphed to the market, the announced tariffs were at the upper end of expectations.

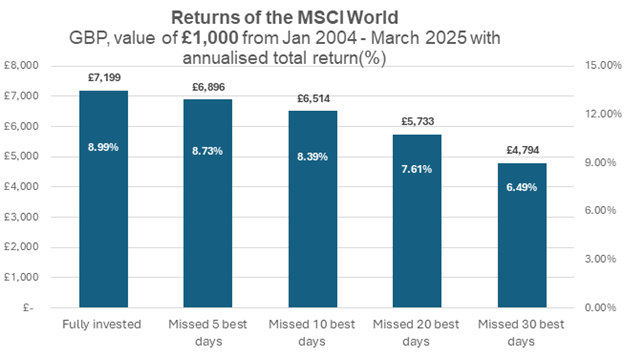

- Volatility such as we’re currently seeing is certainly uncomfortable. However, it is not uncommon. We recommend that investors stick with their long-term investment strategy and avoid making knee-jerk investment decisions – reminding ourselves that time in the market has proven to be a better strategy over time than trying to time oneself in and out of the market.

- Getting to the specifics of what was announced, April 2nd (President Trump’s so named “Liberation Day”) saw the US impose a blanket 10% tariff on all countries. In addition, there were higher rates imposed on nations which the US has larger trade deficits with. The EU and Japan were subjected to tariffs of 20% and 24% respectively, with tariffs of 46% placed on Vietnam and additional tariffs of 34% (i.e. on top of the 20% tariffs earlier this year) imposed on China. China was the first country to announce retaliation, imposing a 34% tariff on US goods.

- These moves take the effective US tariff rate up from around 1.7% (based on US International Trade Commission data) to about 21% (based on Bloomberg estimates). This would equate to a hit to US growth of c2.8% (Bloomberg estimates). These are big impacts (hence the market reaction), but we would make the following points:

→ The US economy is coming at this from a position of strength.

♦ Consumer spending has been very strong.

♦ Growth has been above trend (2%) for the last 2.5 years.

♦ Household balance sheets are stronger than they’ve been in over 20 years (and savings rates have recently started to tick up in anticipation of tariffs)

♦ The Federal Reserve has ample room to cut interest rates (and the bond futures market has now moved to pricing in 4 interest rate cuts by the Fed over the course the rest of this year)

♦ There is a whopping $7.2 trillion sat in money market funds which may well be enticed into stock markets as interest rates drop or stocks become cheaper.

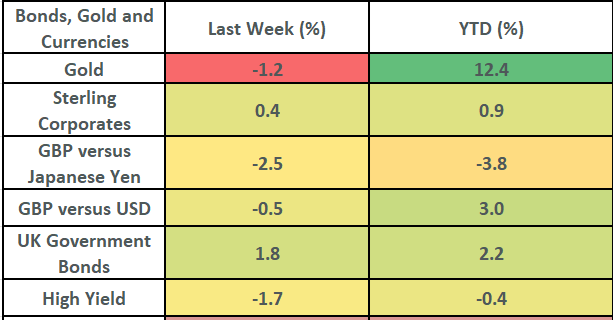

- Uncertainty is likely to remain high in the next few weeks. We’d recommend that investors stick with their long-term investment strategy and resist the urge to make knee-jerk decisions. The chart below shows that on average, global stock markets experience sell-offs of 10% or more roughly once every 2 years and that the average intra-year drawdown for the stock market is 14%. Stock markets don’t give a smooth ride but have been a very high returning asset class through history, yielding an average return of c9% in the 21-year time period shown in the chart.

Source: Bloomberg

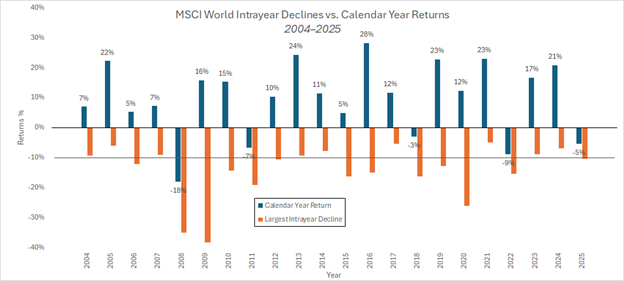

- Furthermore, many of the best days for stock returns tend to come during periods of heightened volatility and missing just a handful of these days can make for meaningfully lower returns.

- Using the same data set, we looked at the opportunity loss associated with jumping out of the market. Missing just a handful of days could mean giving up on meaningful gains. The chart below shows that by missing just 30 of the best days (about 0.6% of the data set) in this time window would make for an investor giving up just over 25% of the return on offer.

- Whilst last week was painful for equity markets, it did highlight the benefits of diversification. Defensive sectors such as Consumer Staples and Utilities held up relatively well and bond markets provided good ballast.

- UK government bonds rose by about 1.8% on the week as yields fell to reflect a faster pace of future interest rate cuts. The UK 10-year government bond yield closed out the week yielding 4.45%, whilst 2-year UK government bonds closed out the week yielding 3.9%. There are now 3 further interest rate cuts being priced for this year by the Bank of England, with the first one being priced at their next meeting on 8th

- Bond futures markets rapidly repriced the pace of interest rate cuts globally last week. At end last week the bond futures markets were pricing in:

- 4 interest rate cuts this year in the US (to take rates down to 3.5%)

- 3 further interest rate cuts in the UK (to take rates down to 3.75%), and

- 3 further interest rate cuts in the Eurozone (to take rates down to 1.75%)

The value of investments and the income from them can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The content of this article is not intended to be or does not constitute investment research as defined by the Financial Conduct Authority. The content should also not be relied upon when making investment decisions, and at no point should the information be treated as specific advice. The article has no regard for the specific investment objectives, financial situation or needs of any specific client, person, or entity.