The last few days have seen some significant drops in global markets, as investor concern about the US economy has seen some investors move out of equities into “safer” assets.

In many ways, this moment was not a surprise as recent surges had seen record highs on some indices, including the UK’s FTSE 100.

In this brief note we will give you some context to what’s been going on from Rory McPherson, Chief Investment Officer of Magnus, a Wren Sterling Group investment management business. Then we’ll touch on why we believe in the long-term value of investments and why holding your nerve is key to riding out volatility.

Here’s Rory on the causes of the movements and what we can expect next:

“Fears around a US recession have been the key driver in the sell-off. In turn, this prompted an unwinding of the “carry trade” which led to heavy selling, particularly within Japanese equities. Thirdly, there’s high concentration of high value technology companies in the US market, which is susceptible to swings in sentiment.

The US economy

“We believe that whilst it is showing clear signs of slowing, the US economy is still in decent shape. Last week, the stock market reacted badly to two adverse data points: a disappointing manufacturing reading on Thursday and a disappointing jobs number on Friday. These both followed Wednesday’s Federal Reserve meeting where the US Fed held interest rates at 5.5%. Yesterday saw the release of two much more positive US data points measuring companies’ intentions to invest and employ more people.

The “carry trade” sell-off

“This part is a little technical, so bear with me. Last week’s poor US data points coincided with the Japanese Central Bank hiking interest rates to 0.25%. This may not sound much but it is symbolic since it marks the highest level in Japanese interest rates since 2008. This rise in Japanese interest rates combined with the weak US data prompted an unwinding of what is known as the “carry trade” which then saw the Japanese stock market fall by 10.5% on Monday 5th August.

“The “carry trade” has been funded by borrowing cheap Yen and then selling those Yen to invest in riskier, higher returning assets. The slightly higher Japanese interest rate, combined with expectations of lower interest rates and lower returns elsewhere, prompted a fast unwind of this trade yesterday because borrowing costs rose for those making the riskier investments. This looks to have righted itself overnight, with the Japanese market closing up 10% this morning (6th August).

High concentration of technology stocks

“The US stock market has been led up by a small number of large technology focused stocks. These stocks have been powered by the boom in Artificial Intelligence spending and are generally trading at high valuations. Their earnings have been fantastic, but the bar for surprising to the upside is now very high.

“As a cohort, these stocks have driven the market higher for much of this year, but in the last three weeks they have weighed on returns. Last week saw four of these big companies (Meta, Microsoft, Apple and Amazon) report their second quarter earnings. All of them beat their earnings’ expectations, but Amazon missed on its revenue expectations and guided downwards for its Q3 expectations. Given the high valuation (Amazon trades on about 28x forward earnings) and the shaken market mood, the stock was penalized with a 9% fall on Friday: this matters when the stock carries a near 4% weight in the US stock market.

“The market was pulled further lower by a 4.65% fall in Apple (which makes up about 6.5% of the US share market) yesterday. This came on news that Warren Buffet’s Berkshire Hathaway was selling nearly half of its stake in the company.”

So, what does it mean for Wren Sterling clients?

It’s easy to look at a dipping portfolio value and panic – it’s our money after all. However, history shows that patience is the key to riding out volatility.

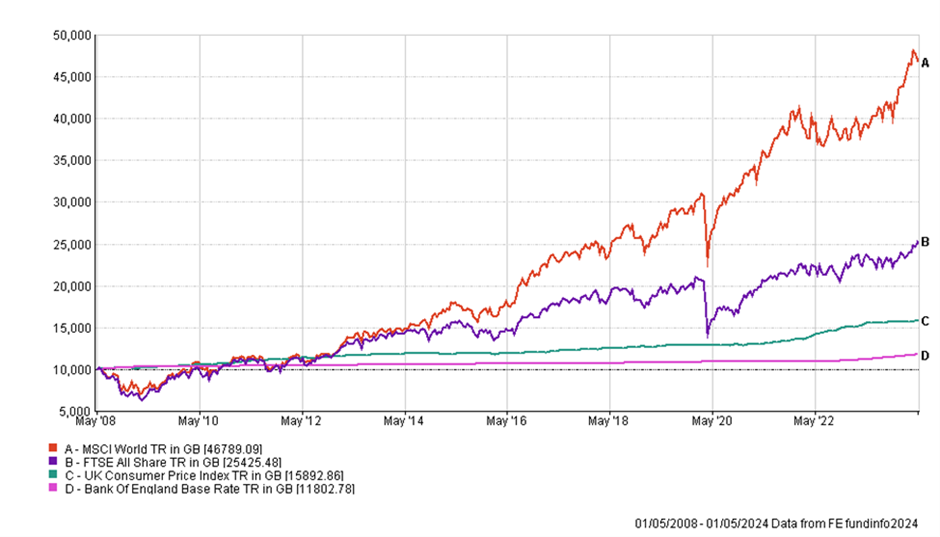

If we think about recent events, such as Covid-19 or the Ukraine war, they had negative impacts on stocks straight away. In this chart we can see the dips in the value of some global and UK based indices at the point of Covid-19 hitting and all losses had been recovered within a few months in both scenarios, with the long-term trend being towards growth.

Past performance is not a reliable indicator of future performance.

Another reason why we’re convinced of the value of investments is the declining attractiveness of cash. As interest rates were lowered last week, we expect further cuts in future months.

Finally, volatility can present buying opportunities for investors with a long-term view. If you believe that over the long term, markets will grow, then a fall back means that there’s even more ground to be made up and space to grow returns. That’s why it’s especially important for long term investors to follow the “time in the market is better than timing the market” rule and remain invested. Selling investments now and hoping to capitalise on a rising market in future is unlikely to pay off!

Getting in touch

There’s comfort in data, but we recognise that psychologically, that can be difficult to stomach. That’s why speaking to your Financial Planner at times like this is always a good idea. We’ve got the long-term perspective (and we’re long in the tooth on market movements), so please get in touch straight away if there’s anything you would like to discuss.

The value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not a reliable indicator of future performance.

The information contained within this newsletter is for guidance only and does not constitute advice which should be sought before taking any action or inaction. The article had no regard for the specific investment objectives, financial situation or needs of any specific client, person or entity.

Magnus is a trading name of Magnus Financial Discretionary Management Limited which is authorised and regulated by the Financial Conduct Authority.