As we count down the days to the first Labour Budget in nearly 25 years, it is reasonable to say that there is an elevated amount of speculation as to what Rachel Reeves will do to address the stated “£22-billion black hole” in the public finances for this year. This is on top of the growing pressures on government spending due to an aging population and the challenges of increased spending on health and pensioner social security, which combined, accounted for around 30% of total government spending in 2022-23.

It is certain that in the face of this, the UK Government faces a number of tough decisions, and the Prime Minister has already warned of a “painful” budget. With manifesto pledges to not increase Income Tax, National Insurance or VAT, the options available as to where to generate additional income are limited.

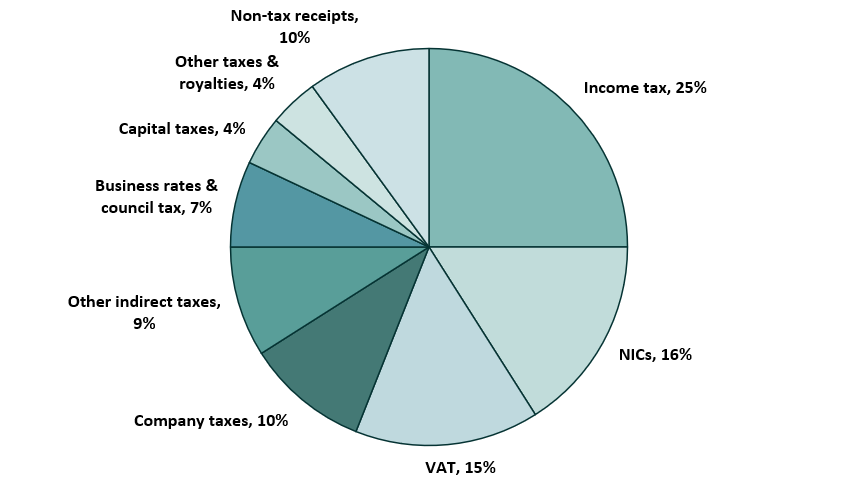

The chart below details the forecast percentage of government income from various taxes for the tax-year 2023-24 based on data from the Institute for Fiscal Studies (IFS)1.

As the three protected taxes account for 56% of the forecast income, or £602.5bn of the total £1.06 trillion income the government received, the ability to ‘plug the gap’ from the remaining tax areas would, on their own, require significant uplifts in rates. That of course assumes that behaviours didn’t change as a result.

Amongst the speculation so far, the leading candidates for change are Capital Gains Tax (CGT) and Inheritance tax and the associated reliefs. As part of this update, we want to look at the possibilities around CGT.

The current situation

The current CGT rates are:

- Gains on residential property are taxed at 24% (18% if the individual is a basic rate taxpayer).

- Gains on most other assets are taxed at 20% (10% if the individual is a basic rate taxpayer).

- The first £1million of gains relating to qualifying business assets may be taxed at 10% with the balance taxed at 20%, under Business Asset Disposal Relief (BADR).

When compared to Income Tax rates, which can be up to 45%, the current CGT rates are relatively low.

Possible scenarios

With CGT rates at comparatively low levels compared to income tax, there is growing speculation that CGT rates might increase, either to a flat rate of 40% or maybe to align with the income tax rates.

Of course, without a crystal ball, we are uncertain about:

- Whether these changes will happen,

- When those changes would be implemented, and

- Whether any transitional measures (such as the re-introduction of inflation (indexation) relief) would be introduced alongside these changes.

This makes it a challenge to determine whether we should act now or await further clarification on the 30th of October.

At present, we are considering a few possible scenarios:

- No Change in the Tax Rate: If the CGT rate remains at 20%, acting now would have been unnecessary, and any taxes paid on realised gains could have been deferred.

- Increase to 40%, but only on future gains: If the tax increase only applies to future gains, we can manage your tax exposure by holding onto your current assets, knowing that gains already realised would still be taxed at 20%, and only future gains would face the 40% rate.

- Retroactive Tax Increase to 40%: If the tax increase is applied retroactively to all gains realised during the entire financial year, holding assets without acting now could result in a significantly higher tax liability on your current gains than anticipated.

- Reintroduction of indexation relief alongside the higher rates. This was removed by the previous Labour government in 2008 and is arguably one reason why the current rates of CGT differ so markedly from Income Tax rates. Its reintroduction would allow individuals to exclude the effects of inflation from their gains when selling an asset. This would provide some protection against higher tax rates and may in certain cases reduce the tax liability over that which would be due today.

- Grace Period Until the End of the Tax Year: There is also the possibility that the Chancellor may introduce a grace period, allowing individuals to realise gains at the current 20% rate up until the end of the tax year. After that, the new 40% rate would apply. This would provide an opportunity to manage your gains more effectively if we act before the grace period expires.

Risk and opportunity

As financial planners, our primary principle is to provide you our best advice based on what we know for certain today, and the rules and reliefs available now.

That is a balancing act and one that requires consideration of realising gains now, at the current tax rates, or holding and potentially face a higher tax rate after the Budget. If a grace period or indexation relief are introduced then we’ll have more time to make this decision allowing us to consider our options before the end of the tax year if necessary.

Our approach now

At this stage, there is no ‘correct’ course of action we can take, but our financial planners are available to discuss your options with you.

Once the Budget is delivered and we have had opportunity to read the full Budget text, we will be in full receipt of the situation and be able to determine the best course your circumstances.

Between now and the 30th of October, our approach is to remain flexible but cautious. We encourage our clients to make full use of the available allowances we have, such as maximising ISA allowances where possible, to mitigate any rise in CGT rates. The motto of ‘not letting the tax tail wag the investment dog’ is one to live by in situations such as these, but we are minded of the potential increase to tax liabilities that clients may face after the budget.

What happens after the Budget?

We will keep our financial planners and clients updated on any developments as soon as possible after they are announced. Your financial planner will be in touch to review any specific implications for your portfolio and discuss whether any actions are needed, particularly if a grace period is introduced.

If you wish to discuss anything in this update, or have any concerns, please do not hesitate to contact your financial planner.