In 2028 to 2029 the OBR anticipates an additional 2.7 million people will be paying higher rate income tax, with 600,000 more additional rate tax payers. It’s likely that these people will therefore be faced with more complex tax issues, and may incur an unexpected tax bill thanks to the Tapered Annual Allowance.

Tapered Annual Allowance Guide

How does this affect higher earner’s pension contributions?

What is Tapered Annual Allowance?

Most people can choose to personally contribute 100% of their salary (or £3,600 if more) each year into their Defined Contribution pension and receive tax relief on their contributions. That’s in addition to any contributions made by their employer. However, if total contributions from all sources, employer included, go over the annual allowance, a tax charge applies to the excess amount. Most people have an annual allowance of £60,000 (or 100% of their salary, which ever is lower). That’s not the case for those with very high incomes.

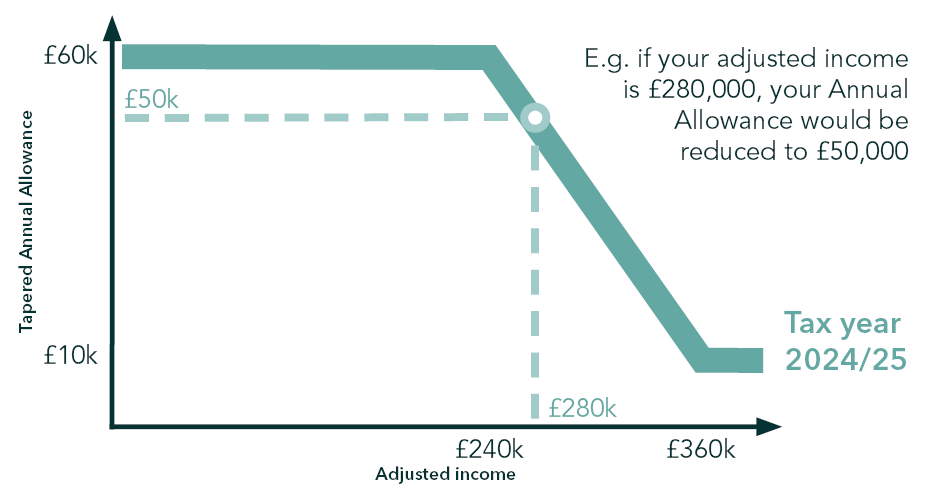

The Tapered Annual Allowance reduces the amount those with very high incomes can contribute to their pensions each year, without suffering a tax charge. If you exceed this amount, you could face an Annual Allowance charge. For those affected by the Tapered Annual Allowance, their Annual Allowance (the amount they can contribute to their pension each year without suffering a tax charge) reduces by £1 for every £2 that their adjusted income exceeds £260,000 (assuming their threshold income is above £200,000) down to a minimum of £10,000.

Why Tapered Annual Allowance was introduced

The Tapered Annual Allowance was introduced in 2016 to limit tax efficient pension funding for higher earners, controlling the cost of pensions tax relief.

Understanding the taper and staying within its limits can be tricky to get your head around. UK Pension legislation is complex – which is why many people choose to talk to a financial adviser about their retirement planning.

How does Tapered Annual Allowance work?

When an individual breaches both the adjusted and threshold income limits, they will see their annual allowance reduce by £1 for every £2 that their adjusted income exceeds the adjusted income threshold, currently £260,000 – to a minimum of £10,000 (correct tax year 2024/25). Contributions above this level (employer and employee combined) will need to be reduced, or the individual will find that they have to declare an Annual Allowance charge in their tax return.

If an individual has already begun taking taxable money from their pensions on a flexible basis such as via flexi-access drawdown, then the Money Purchase Annual Allowance (MPAA) applies, and their Annual Allowance for future money purchase pension funding would already be £10,000 (tax year 2024/25). Carry forward of unused annual allowances is possible for those subject to the tapered annual allowance, but the MPAA can’t be increased using carry forward.

For example, if your adjusted income was £280,000 your annual allowance would be reduced to £50,000. This tapering continues until your adjusted income reaches £360,000, at which point the minimum Annual Allowance of £10,000 applies.

Let’s look at the two measures that will determine if you will trigger the Tapered Annual Allowance; adjusted and threshold income.

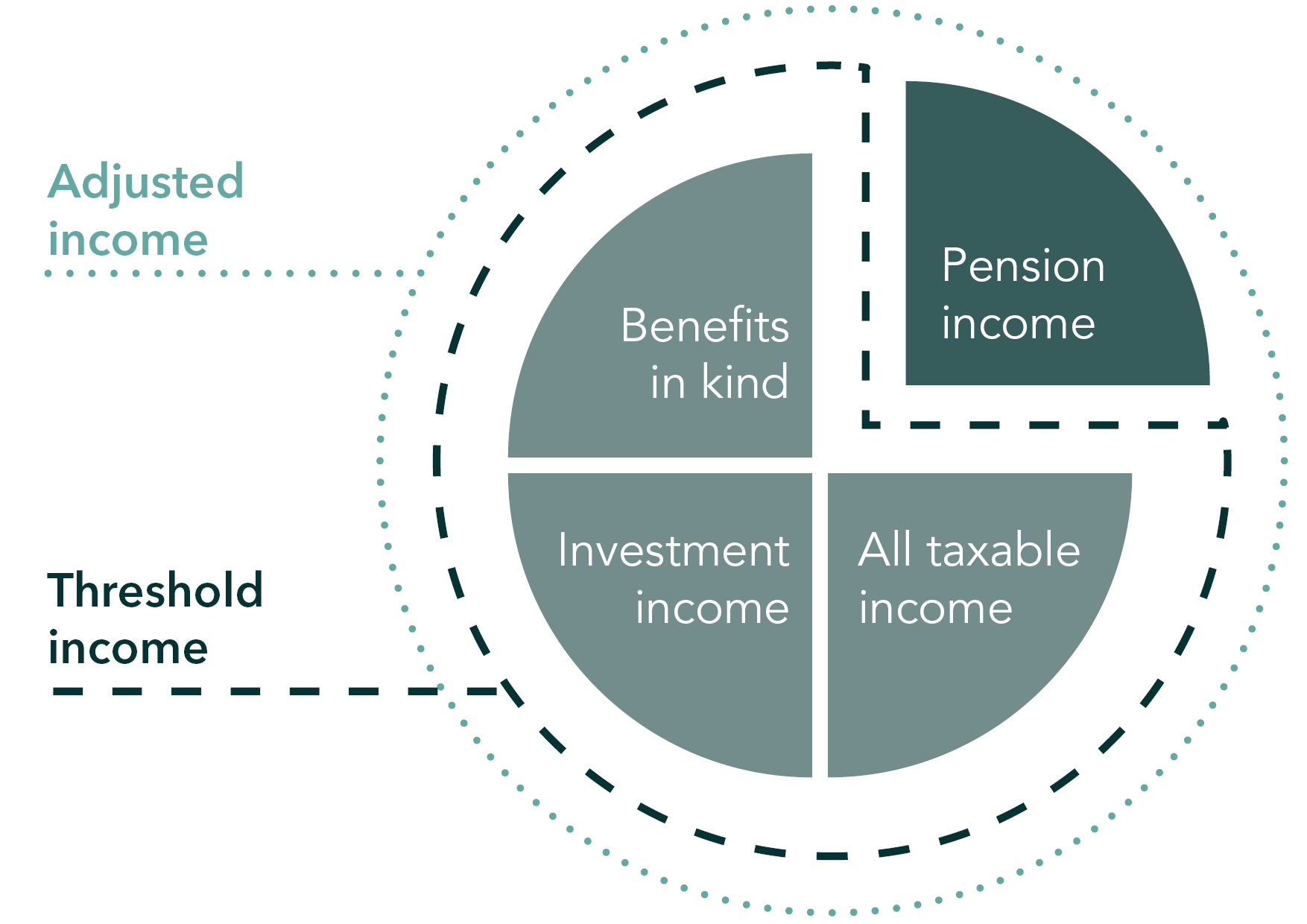

What is adjusted income?

Your adjusted income includes all your taxable income, any bonuses, benefits in kind (medical insurance payments), pension income (including employer pension contributions and salary sacrifice) and investment income.

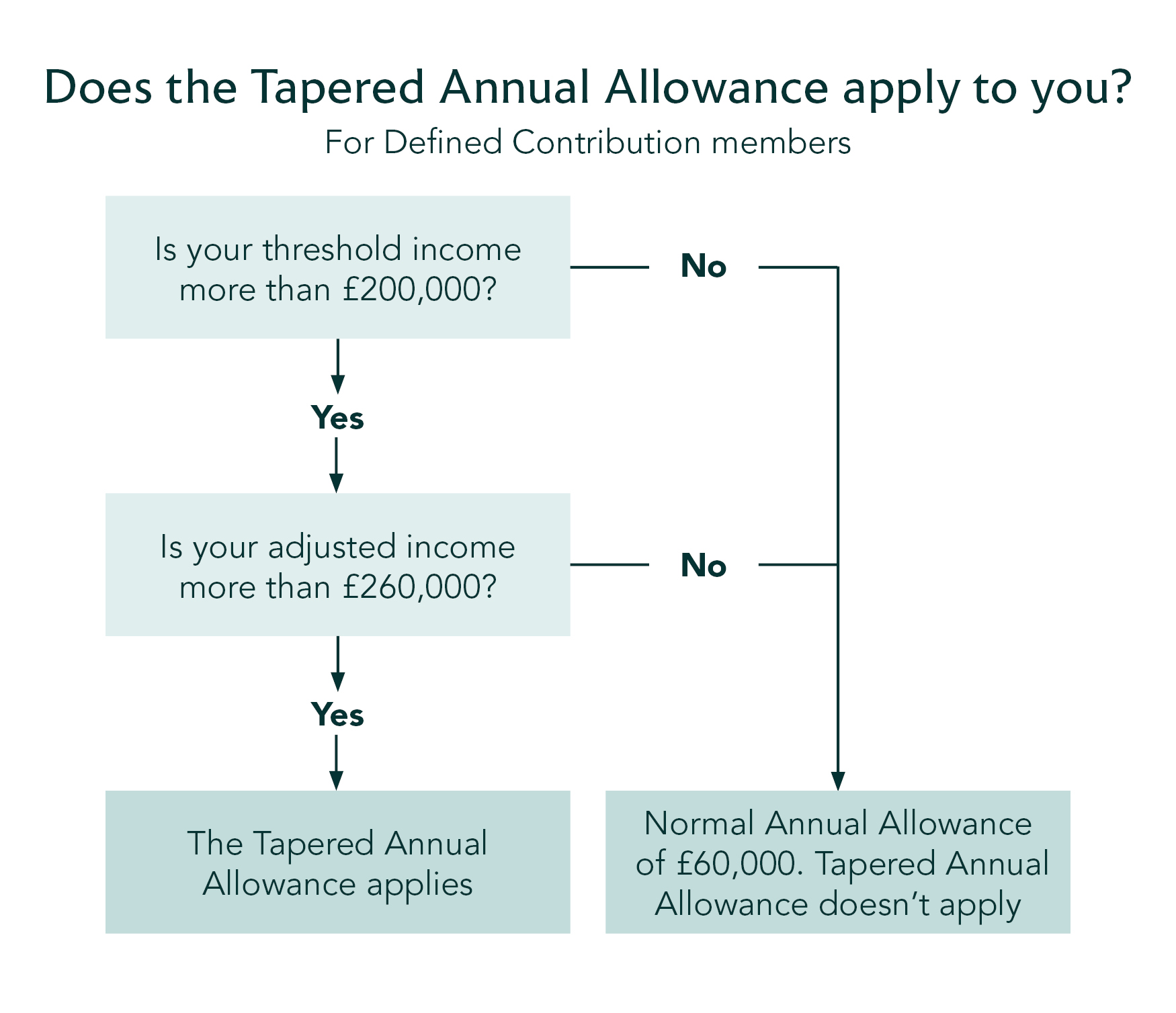

If your adjusted income is above £260,000 then the Tapered Annual Allowance may come into effect – only if you also exceed the £200,000 threshold income limit.

What is threshold income?

Your threshold income is your taxable income (including benefits in kind, investment income, etc) excluding your pension contributions. This measure is used to reduce the impact of the Tapered Annual Allowance on individuals with irregular earnings, such as self-employed workers.

If you exceed both the adjusted income and threshold income limits, then the Tapered Annual Allowance will apply. The Tapered Annual Allowance won’t apply if your threshold income doesn’t exceed £200,000.

If you’re struggling to work out whether the Tapered Annual Allowance applies to you, the gov.uk website can provide further guidance.

Tapered Annual Allowance planning

-

Look at the ‘whole picture’

Individuals in higher tax brackets should review their plans regularly to make use of the reliefs and allowances available to them. You may consider asking a Financial Adviser to help you, as pension rules shouldn’t be considered individually. Other rules and allowances (such as Carry Forward, the Money Purchase Annual Allowance) may also affect your planning. These can help you avoid an unexpected tax charge.

-

Pension legislation can change

Pension legislation is always subject to change, and can affect your retirement planning. For example, the Lifetime allowance was replaced in April 2024 by the Lump Sum Allowance and Lump Sum and Death Benefit Allowance. These limits no longer restrict the amount of pension benefits you can build up tax efficiently – the new limits are only concerned with the amount of tax-free lump sums you, or your beneficiaries after your death, are able to receive from your pension plans.

What happens if you exceed your reduced tapered annual allowance?

The ‘carry forward’ rule allows pension savers to build up their pension with any unused allowances from the previous three tax years as long as they held a pension plan in those years. If your calculations show you will exceed your Tapered Annual Allowance, you should check if you can use this rule to reduce or remove this excess.

If this is not possible, and you still exceed your Annual Allowance, you will be subject to a tax charge. The excess funding will be subject to income tax at your marginal rate (40% for Higher Rate tax payers, 45% for Additional Rate tax payers). The tax charge must either be paid by you via your tax return or can, in some cases, be paid by way of a deduction from your pension pot.

How can Wren Sterling help with Tapered Annual Allowance?

In 2028 to 2029 the OBR anticipates an additional 2.7 million people will be paying higher rate income tax, with 600,000 more additional rate tax payers. More pension savers are likely to encounter the complex rules around tax efficient pension funding.

Understanding the UK pensions legislation can be difficult – which is why many people choose to get in touch with us and talk to a Wren Sterling financial adviser about their pensions and retirement planning.

Your financial adviser could help you avoid an unexpected tax charge – and possibly remove it. Or, suggest other tax-efficient saving products to save for retirement.

Our Guides – Learn more about annual allowances

If you’d like to learn more about the financial planning strategies Financial Advisers can use for your retirement planning, you may enjoy our guide on ‘pensions tax planning for higher earners’. We take a closer look at the other rules and allowances that can affect your retirement planning; including contribution planning, salary sacrifice, using SIPPs (Self-Invested Personal Pensions) and specialised investments.

FAQs

-

What is adjusted income?

What is adjusted income?

Your adjusted income includes all your taxable income, benefits in kind (medical insurance payments), pension income, employer pension contributions, and investment income.

-

What is threshold income?

What is threshold income?

Your threshold income is your taxable income (including benefits in kind, investment income, etc) excluding your pension contributions. If you have used salary sacrifice to increase your employer’s pension contributions, the salary sacrificed must still be included in threshold income.

If you exceed both the adjusted income and threshold income limits, then the Tapered Annual Allowance will apply. The Tapered Annual Allowance won’t apply if your threshold income doesn’t exceed £200,000.

-

What happens if you have already triggered the Money Purchase Annual Allowance?

What happens if you have already triggered the Money Purchase Annual Allowance?

If you have already begun taking taxable money flexibly from your pension/s, then the Money Purchase Annual Allowance applies, and your Annual Allowance for money purchase pension funding will be £10,000 (tax year 2024/25).

-

What is annual allowance?

What is annual allowance?

Your Annual Allowance is the total amount you, and others on your behalf such as your employer, are able to contribute to your pension each year, without you suffering a tax charge.

-

How do you calculate adjusted income and threshold income?

How do you calculate adjusted income and threshold income?

If you exceed both the adjusted income (£240,000) and threshold income (£200,000, tax year 2024/25), then the Tapered Annual Allowance will apply. You will need to have figures for all your taxable income on hand, including benefits in kind (medical insurance payments), pension income (including employer contributions) and investment income.

-

What is pension carry forward?

What is pension carry forward?

The ‘carry forward’ rule allows pension savers to build up their pension with any unused allowances from the previous three tax years. If your calculations show you will exceed your Tapered Annual Allowance, you should check if you can use this rule to reduce or remove this excess.

-

What is flexible drawdown?

What is flexible drawdown?

Pension Drawdown allows you to control your access to your pension funds. As long as you’re confident managing your money, you can use this to create a flexible retirement income.

The Financial Conduct Authority does not regulate tax planning.

The information contained within this article is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases and reliefs from taxation may be subject to change.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age). The value of your investments (and any income from them) can down as well as up which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation which are subject to change. You should seek advice to understand your options at retirement.