“The X-Factor” was the title of my 2024 outlook published in January this year, with the “X” symbolising the ballot box entry of the roughly two billion eligible voters who headed to the polls in what’s been the largest election year in history.

From a political standpoint, the “X” marked a vote for populism and for change, with new leaders elected in the UK, the US, Indonesia and Pakistan.

Indeed, Mexico was the only major non-authoritarian country where the incumbent party improved upon their result. The assassination of over 30 candidates might well have strongly influenced the campaigning – it certainly puts a faceful of McDonalds’ milkshake into perspective!

From an investment perspective, the “X” was a vote for increased spending and increased growth, with the election of President-Elect Trump for a second term in the US being the striking example here. “X” also denotes the social media company, formally known as Twitter. Having reinstated Donald Trump’s account (following, you guessed it, another vote!) in 2022, we’re likely to see a ratcheting up of tweets from the President-Elect, with many directed the way of Federal Reserve Chair Jerome Powell – more on that later.

Early indications are that financial markets have given a “thumbs-up” to the new US President-Elect, whilst the reaction here in the UK to the new Labour government has been more subdued.

Increasing spending is an easier lever to pull than increasing growth. To that end, we expect to see increased pressure on Central Banks to lower interest rates to relieve pressure on the consumer and stimulate growth.

Increased spending and lower interest rates will likely create slightly higher inflation. Swap markets (which mortgages price off) have now moved to pricing this, with long-term expected inflation now priced at around 2.5% (source: Bloomberg) in the US and the UK. This is bad news for savers (cash gets eroded and to a greater extent as cash rates reduce), but good news for governments (it erodes their burgeoning debt piles) and good news for investments (particularly those with strong pricing power) that will get a boost from lower interest rates.

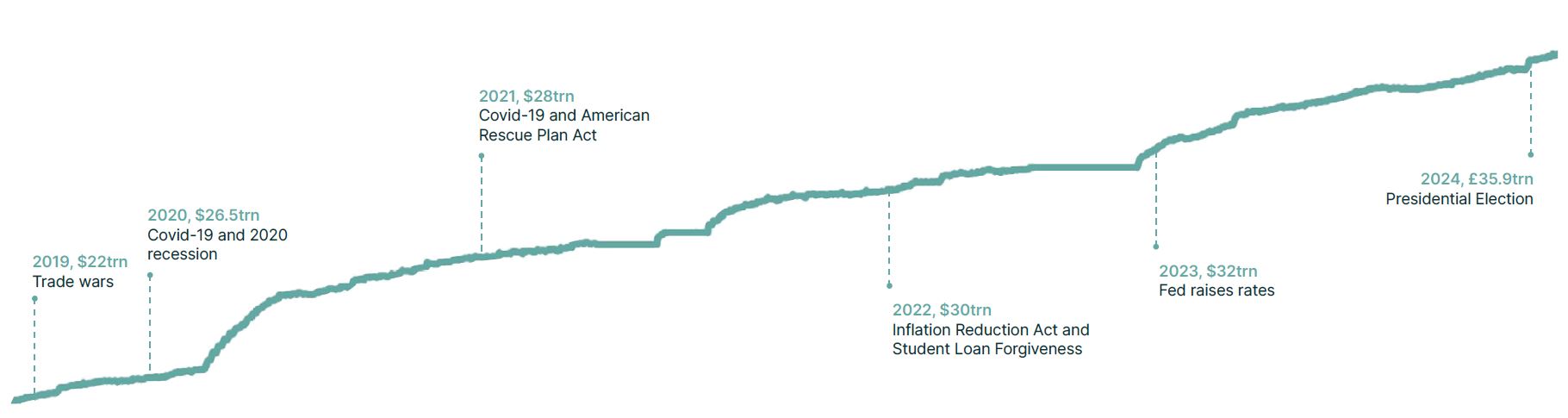

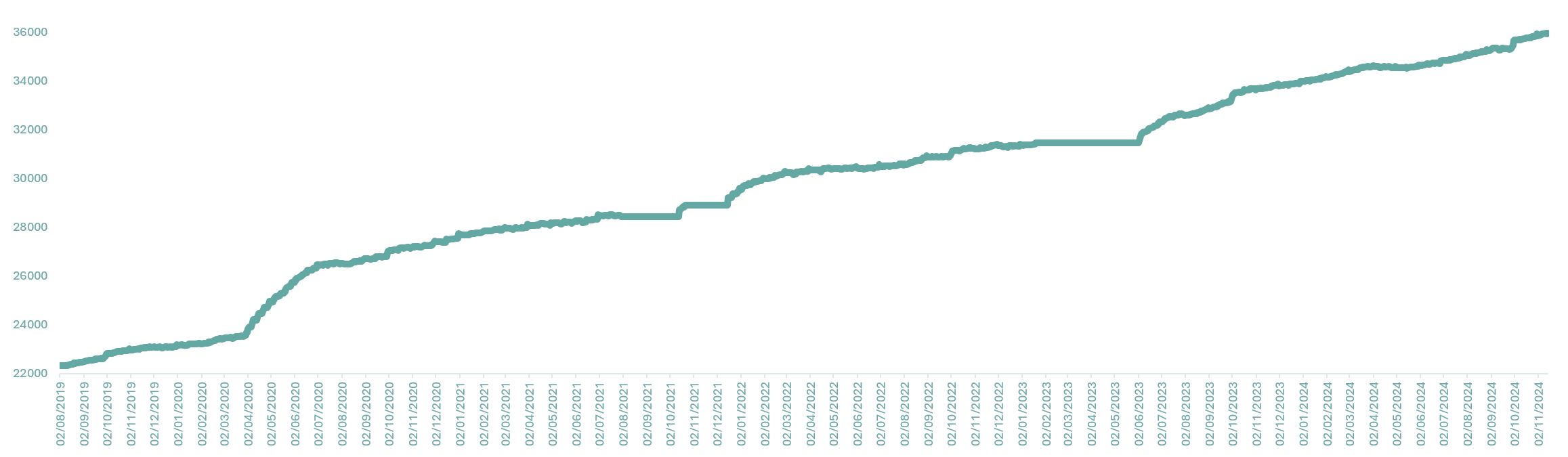

US debt levels are now approaching $36trn and President Trump is likely to keep on spending!

Source: Bloomberg

Let’s talk about debt levels

US debt is at record levels: (some!) inflation would be a nice way of eroding the debt pile… see chart below.

Debt levels in the US are within touching distance of $36 trillion dollars. To put this into more relatable terms, this is equivalent to 10 towers of Dollar bills stretching from the earth to the moon! A vast amount of money!

$36 trillion is a staggering amount of money in and of itself, but the debt service costs on it are also eye watering. $1 trillion is the expected debt service cost for 2025 according to the US Congressional Budget Office (CBO). Getting the debt level down is one answer, but that requires austerity which isn’t popular and President-Elect Trump is also not a fan. Lower interest rates (and therefore lower debt service costs) combined with slightly higher inflation might be the answer.

Cue the revival of the anticipated X/Twitter spat

President-Elect Trump has already challenged the independence of the Federal Reserve and sent a warning shot to Fed Chair Jerome Powell in saying that “I think I have a better instinct than, in many cases, people that would be on the Federal Reserve or the Chairman”1. This sets us up for a potential re-run of Trump’s first term where he regularly ridiculed Fed Chair Powell claiming he had “no guts, no sense, no vision!”2 and that interest rates should be brought “down to zero, or less”3. President Elect-Trump may even feel emboldened this time round.

Fed Chair Jerome Powell and his voting committee have already indicated a path to cutting interest rates, with the most recent “Summary of Economic Projections” indicating one further rate cut this year, with four to follow next year. The likely inflationary boost to spending (through Trump’s policies) may well argue for less cuts than this, but you can expect @realDonaldTrump to be banging the drum heartily for more!

We focus on the US here, since it’s the biggest economy in the world, and President-Elect Trump is a divisive figure with a decisive majority. It’s a similar, though less headline-grabbing story in the UK. UK Government debt levels have reached £2.8 trillion, with debt service costs expected to be c.£100bn per year according to the Office of Budget Responsibility (“OBR”). Sir Keir Starmer might not share the sledgehammer approach adopted by his soon-to-be US counterpart, but he too will be hoping for lower interest rates from the Bank of England.

Given the recent surge in expected spending that we’ve seen following the US election and the UK budget, it’s likely that there will be slightly fewer interest rate cuts than first thought, but that they will still be forthcoming. This breathes new energy into investment markets: particularly share markets which have pricing power and bond funds which are able to benefit from higher-than-expected inflation and already high starting yields. We are pleased to report that we can find many investments which tick these boxes.

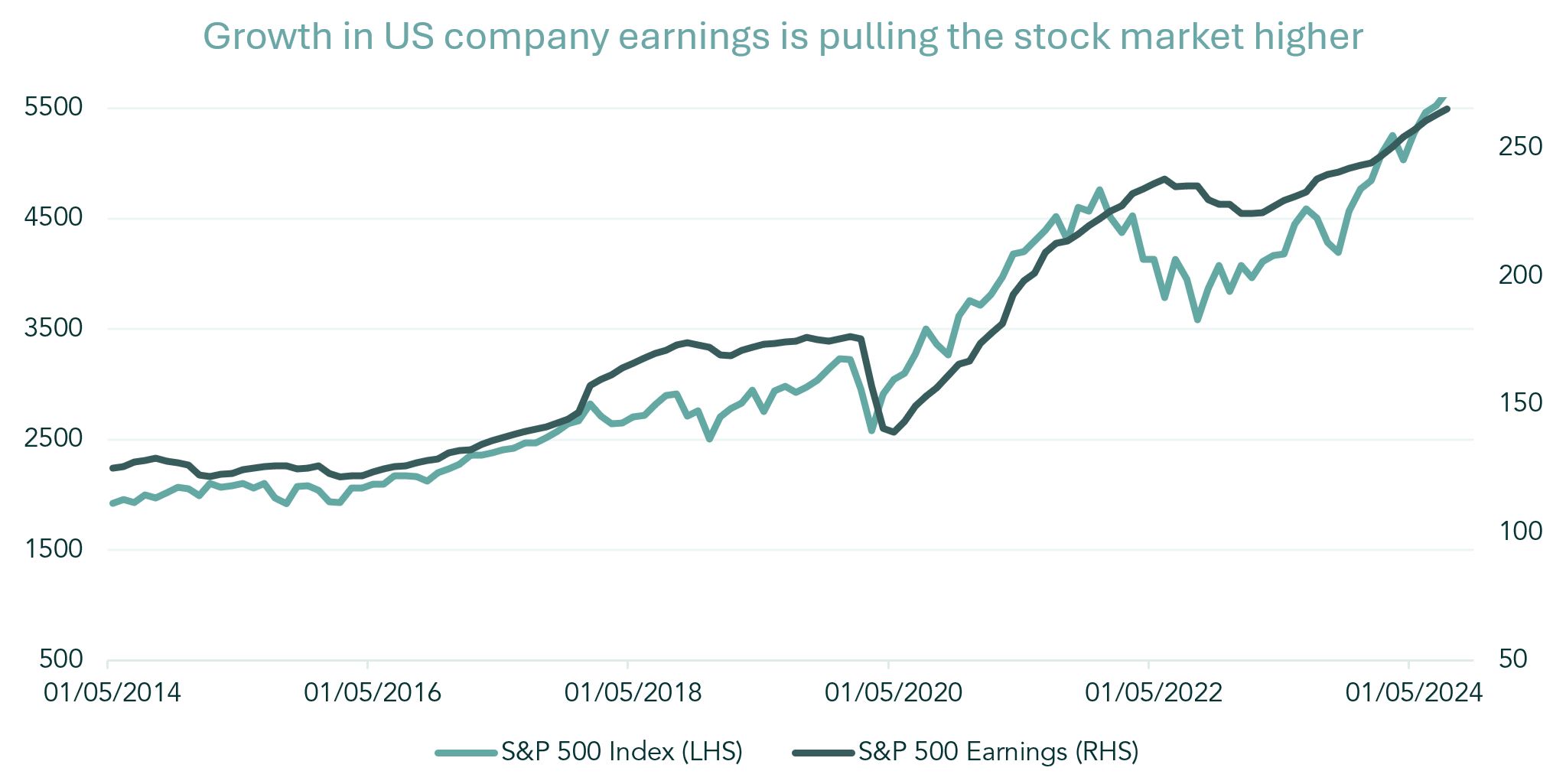

Moreover, we’re seeing continued and consistent evidence of companies being able to make higher profits. We’ve now had five consecutive quarters of positive profits growth for US companies. This matters for investors, since the US equity market forms a very large part of the global benchmark.

US companies have now had 5 consecutive quarters of earnings growth (S&P 500 Earnings).

This has powered the strong stock market performance (S&P 500 index).

As interest rates get cut, so too do bank account interest rates and money market funds (which are popular in the US) become less attractive. This should provide further support for investment markets, with assets in US money market funds having nearly doubled (to $6.5 trillion) over the course of the last 5 years according to the St. Louis Fed.

For UK companies, it’s a much more early innings story, but we are on track for our second consecutive quarter of positive earnings growth and have seen some fantastic results from the Banking sector (citing a stronger UK consumer) and some strong results from select retailers, with companies such as Next and Marks & Spencer boasting solid earnings numbers and the ability to grow revenues and take market share. Set these dynamics against cheap valuations and high degrees of share buybacks (notably from the Banks) and it becomes an exciting investment story.

Assets in US money market funds have gone up 1.8 times in the last 5 years to a record $6.5 trillion!

Source: Total Financial Assets, Board of Governors of the Federal Reserve System (US), FRED

Within Bond markets, we retain a preference for top-rated and short-dated company bonds where we can find yields of 1% to 1.5% above what we’d otherwise get on cash. We’ve also looked to gain from increased Government spending by taking advantage of inflation-linked bonds which will benefit from the anticipated rise in inflation.

The “X” in the ballot box for 2024 has, in our view, been a vote for a big increase to Government spending and a modest uptick to inflation. The “X” factor for investors will be recognising that cash is not King in this environment and that it makes sense to own a diversified pool of assets that can grow their profits by capturing growth and passing on price rises.

1 Former President Donald Trump. 8/8/2024. Comment at a Press Conference at his Mar-a-Lago estate

2 September 18, 2019. Source Twitter

3 September 11, 2019, Source Twitter

The information in this article does not constitute advice or a recommendation and investment decisions should not be made on the basis of it.

The value of investments and the income from them may go down as well as up and you may not get back the full amount invested. Past performance is not a reliable indicator of future results.