If you’re accessing your money from your pensions, you may be subject to either a reduction in tax relief received or a reduction in future possible contributions.

It’s important to be aware of the Money Purchase Annual Allowance (MPAA) – because once you have flexibly accessed taxable income from a Defined Contribution pension, your ability to receive tax relief on future pension contributions may be restricted.

What is the Money Purchase Annual Allowance?

For some people the first time they hear about the Money Purchase Annual Allowance is when they receive a letter from their provider telling them that it has been triggered.

Benefits of the Money Purchase Annual Allowance

The Money Purchase Annual Allowance is a limit designed to prevent people from recycling income and repeatedly benefiting from tax-relief on their pensions and benefitting from additional tax-free cash – rather than benefitting pension savers.

There are some reasons why you may choose to contribute to a pension after taking pension benefits, such as:

-

Phased retirement

Individuals taking a phased-approach to retirement (working fewer hours and drawing on their pension to make up reduced income) who have not opted out of their workplace pension can still contribute to a workplace pension and benefit from contributions from their employer.

-

Estate Planning

Your pension is not currently considered to be part of your estate for the purposes of inheritance tax. A pension can be a useful tool when planning your legacy, as your beneficiaries can inherit the plan without paying further tax. They may be subject to income tax on withdrawals. However, from April 2027, the tax treatment of pensions on death is expected to change, following announcements by the government.

(You can find out more about this in our article on the Lump Sum Death Benefit Allowance.) In order to give your pension more time to benefit from investment growth, and depending on your situation, you may wish to use savings or income from other investment vehicles (like ISAs) before drawing on taxable pension funds.

What triggers the Money Purchase Annual Allowance?

Gordon Smith an Independent Financial Adviser in Wren Sterling’s Holywood office in Northern Ireland discussed some client cases where the Money Purchase Annual Allowance was triggered:

“Unless you’re confident that you won’t be contributing large sums to your pension in future, most will avoid triggering the Money Purchase Annual Allowance. I have had clients that have still been contributing around three, four, five thousand pounds a year, who needed an ad-hoc lump sum for a house move or a once-in-a-lifetime trip and have chosen to trigger the Money Purchase Annual Allowance.

“In these cases, we’ve always warned them of the possible Annual Allowance charge, particularly for those with a phased retirement who are still contributing to a workplace pension. The increase to £10,000 has certainly been welcome as this limit had affected a lot more people over time thanks to Auto Enrolment pensions and inflation. While most people I deal with are at retirement stage we always discuss the Money Purchase Annual Allowance as retirement doesn’t suit everybody.”

Please note that not all lump sum withdrawals will trigger the MPAA.

It’s really important that your financial adviser is aware of all your pension pots so that we don’t create future tax problems. Remember – any DC pension scheme could trigger the Money Purchase Annual Allowance.

Gordon Smith,

Wren Sterling

Please note that it does not affect the pension income you receive, but it does restrict how much you (and your employer) can pay into DC pensions going forward without facing a tax charge.

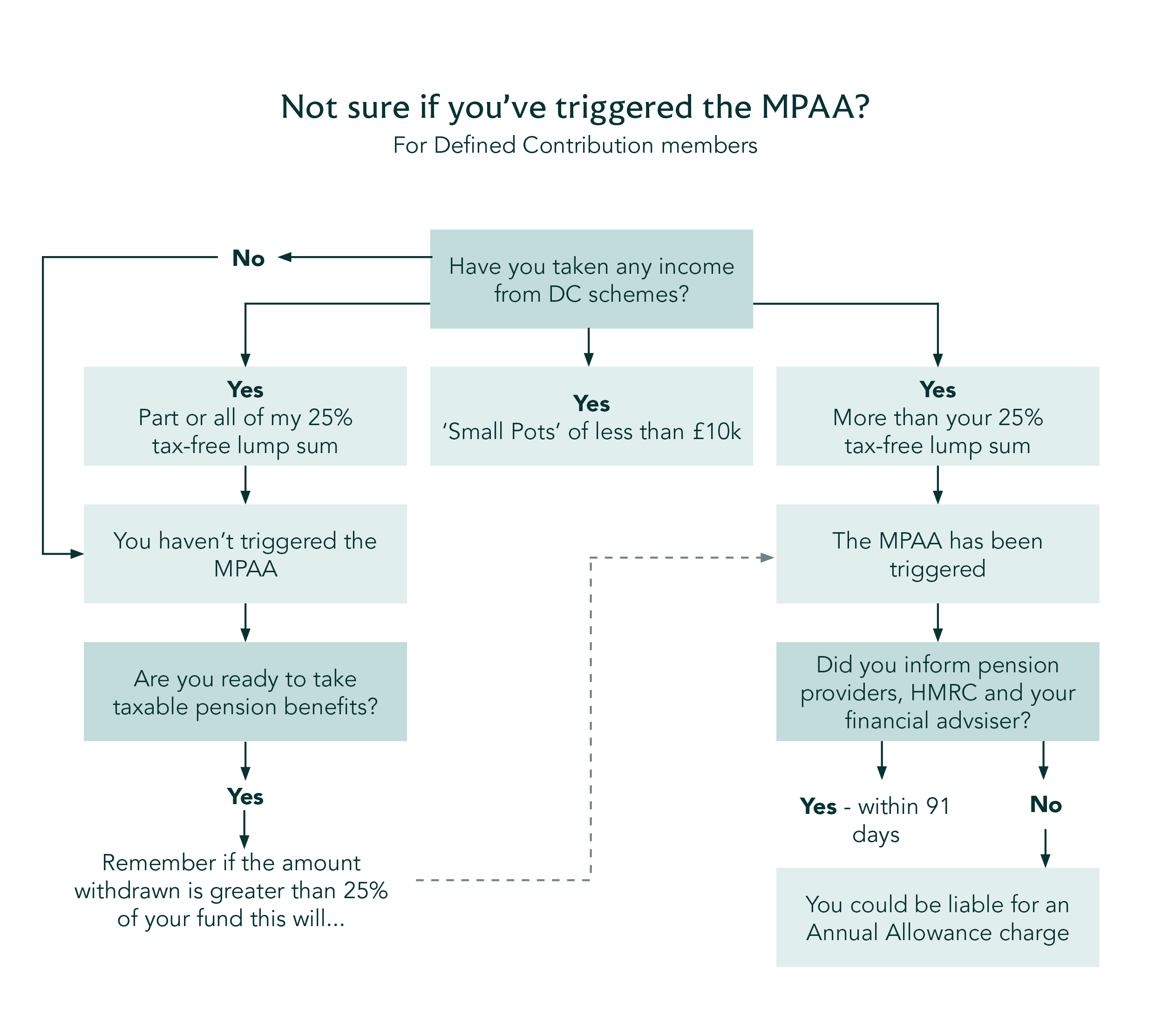

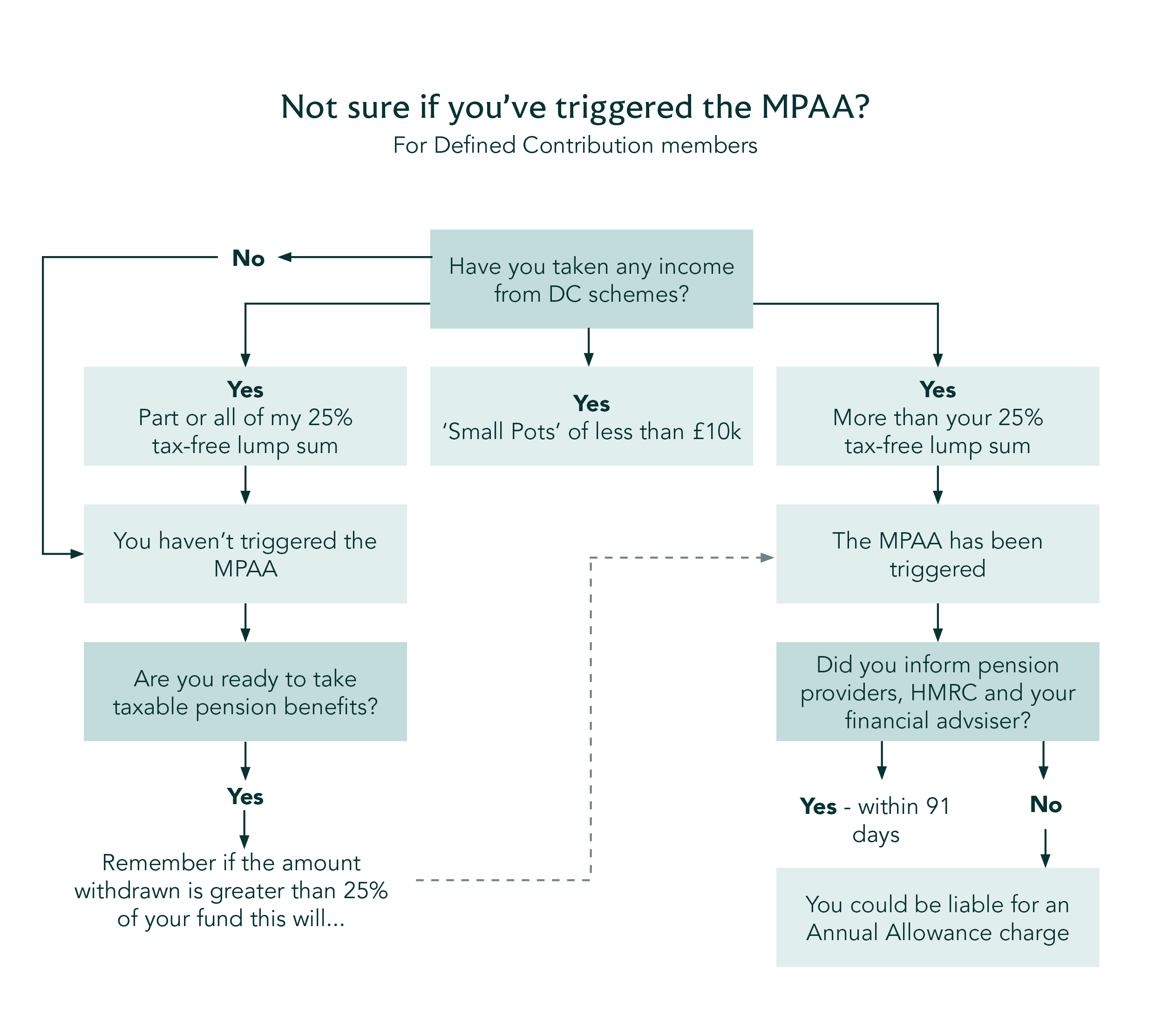

When is the Money Purchase Annual Allowance triggered?

Withdrawing the tax-free portion of your DC pension will not trigger the Money Purchase Annual Allowance. You can use this tax-free lump sum as income, to create an annuity or another pension vehicle such as a flexi-access drawdown pension. So, what does trigger the Money Purchase Annual Allowance?

- Taking taxable income from a flexi-access drawdown fund

- Being in flexible drawdown before 6 April 2015 (automatic Money Purchase Annual Allowance trigger on 6 April 2015)

- Taking an uncrystallised funds pension lump sum (UFPLS)

It’s important to remember that the Money Purchase Annual Allowance will apply to any of your future pension income.

Money purchase annual allowance rules

Before triggering the Money Purchase Annual Allowance, it’s important to be aware of how it interacts with Defined Benefit pensions, and other pension legislation such as the Carry Forward rule.

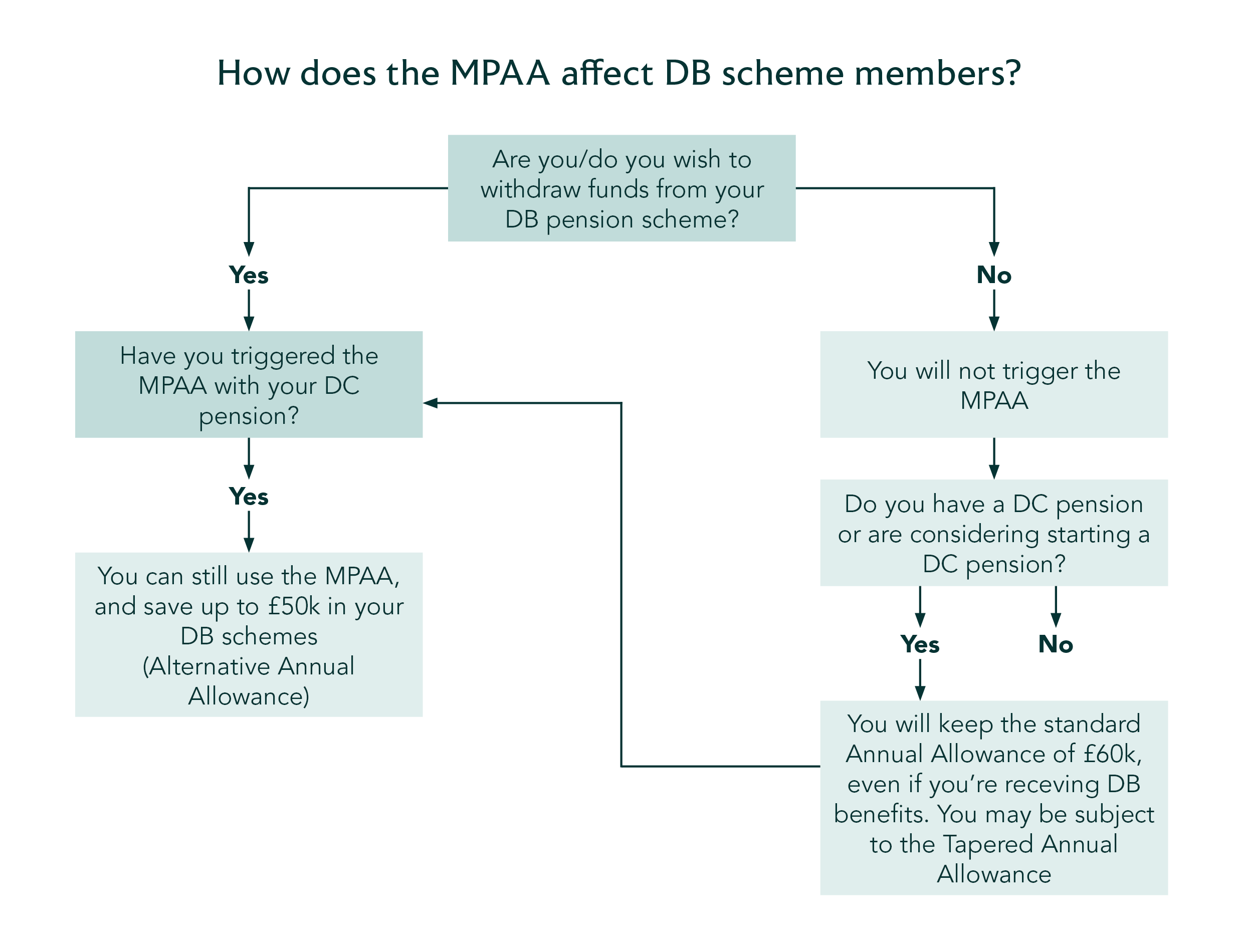

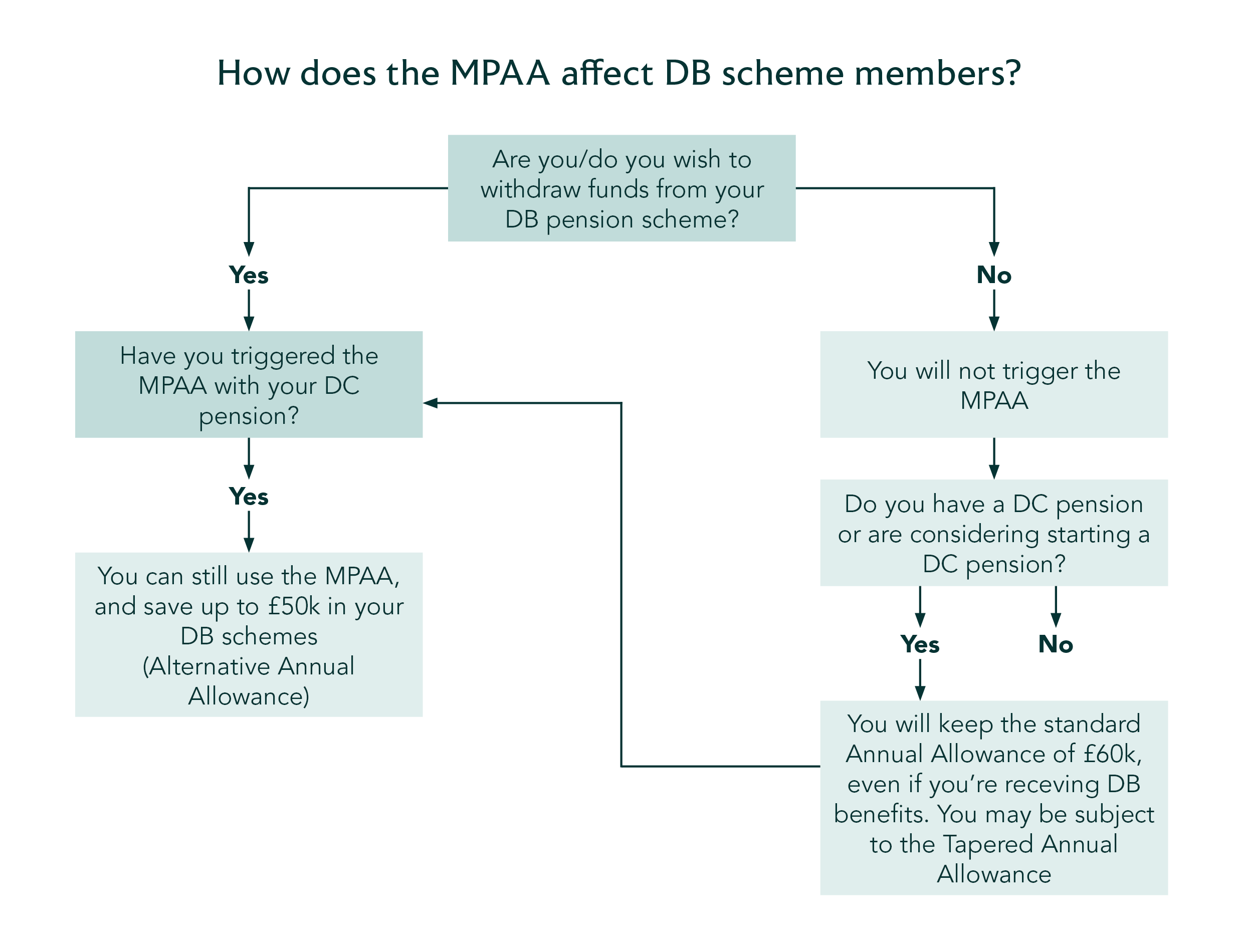

Defined Benefit schemes and the Money Purchase Annual Allowance

Defined Benefit pensions do not contribute towards the Money Purchase Annual Allowance. However, once you’ve triggered the Money Purchase Annual Allowance, the maximum you will then be able to contribute to a Defined Benefit scheme each year will be £50,000 (bringing your total pensions saving up to a total of £60,000.)

Inform others about triggering the Money Purchase Annual Allowance

When the MPAA has been triggered, you’ll receive a notification letter (known as a ‘flexible access statement’) from where you are an accruing member.

Gordon adds, “The letter may take a while to arrive, so its important to make following up with your pension provider a priority, especially if you need to find out who you need to contact. HMRC also need to know if you exceed the Money Purchase Annual Allowance because you’ll have an annual allowance charge to pay on the excess through tax returns. But if your total contributions stay within the limit, no charge will apply.”

“I have a Charity I advise who wanted to contribute to the founder’s pension as they stopped taking pension contributions during a difficult time. When things were going well again, they wanted to make good. Unknown to them he had accessed his pension to help his daughter through university and triggered the Money Purchase Annual Allowance. Unfortunately, his previous financial adviser had not advised him of the consequences of withdrawing taxable income and had not done a holistic ‘whole picture’ review of his future plans. Because of this he would lose a portion of the suggested £60k contribution to tax.”

Carry Forward Rules and the Money Purchase Annual Allowance

For Defined Contribution pensions, you will no longer be able to use Carry Forward rules once you have triggered the Money Purchase Annual Allowance. Gordon Smith shares a memorable example:

“A former client came to me and said they had wanted to withdraw their tax-free cash, but pressed the wrong button on their workplace portal – mistakenly taking this amount as taxable income! This was a Company Director who had planned to make significant pension contributions in the last five years of their employment but is now subject to this £10,000 cap.

She was planning to use Carry Forward rules, but now none of this is available to her. In this instance it was irreversible, even when we suggested she tried to contact her Provider and HMRC. The lesson learned here was that although it is possible to arrange pension withdrawals yourself, she could have used a financial adviser to help her avoid this costly mistake.”

Exemptions from the money purchase annual allowance limit

- Tax-free lump sums – take up to 25% of your Defined Contribution pension as a tax-free lump sum. Subject to protection and the LSA.

- Purchasing an Annuity – Taking tax free cash and purchasing a normal Lifetime Annuity (that can stay level or increase)

- Accessing small pension pots – When a fund’s total value is below £10,000. This is called a ‘small pot’. Individuals can take any number of small pot lump sums from separate occupational pension schemes, and up to three from individual pensions without triggering the Money Purchase Annual Allowance. However, if the fund value is a penny above £10,000, then this will trigger the Money Purchase Annual Allowance.

- DB pension schemes – Receive benefits from a Defined Benefit pension scheme.

- Capped Drawdown schemes – Receive benefits from an Capped Drawdown plan (below the plan maximum).

Other annual allowance limits

Before triggering the Money Purchase Annual Allowance, the Annual Allowance will apply – which is the amount someone can pay into a pension scheme before paying tax on their contributions. Currently this is £60,000 (tax year 2025/26).

This isn’t the only limit to pay attention to. While the Lifetime Allowance was recently abolished, this was replaced by the Lump Sum Allowance (the total amount of tax-free cash you can receive, subject to any available protection. This is £268,275 (correct at 2025/26 tax year) and the Lump Sum Death Benefit Allowance (the limit on all tax-free lump sums that you and your beneficiaries can receive from your pensions). You can find out more about this in our article on the Lump Sum Death Benefit Allowance.) Other benefits are included in the Lump Sum Death Benefit Allowance.